Massive Nevada film tax credit expansion touted as transformational in first hearing

While developers, lawmakers and film companies lauded a long-awaited bill massively expanding Nevada’s film tax credit program during the bill’s first hearing in the Legislature on Tuesday, critics warned of overstressed infrastructure and said the money should be used to address other needs.

The measure, SB496, proposes to gradually expand the program from $10 million in annual film tax credits to $190 million a year over more than two decades, with the amount of credits adjusted annually beginning in 2031 based on the inflation rate.

The vast majority of those credits, $175 million, would be directed to two proposed production campuses in Las Vegas outlined in the bill. That includes the Las Vegas Media Campus developed by Southern California-based Birtcher Development and the Summerlin Production Studios Project developed by the Howard Hughes Corp. in partnership with Sony Pictures, whose representatives say the company is prepared to spend $1 billion on production in Nevada over the next decade.

More than two years in the making, lawmakers introduced SB496 last week, unveiling an initiative with potentially major future budgetary implications in the final month of the legislative session.

The tax credits included in the bill can be used to offset a company’s tax liability, reducing the amount of taxes owed by the amount of the credits, and the proposed credits could be applied to the Modified Business Tax (a tax on payroll), insurance premium tax or gaming license fees. They are transferable, meaning a company can sell them for cash.

Though heralded by proponents as a way to vastly expand the state’s film industry and diversify the Southern Nevada economy, opponents from progressive groups and the Republican Party were heavily critical of the amount of tax credits proposed in the bill, pointing to the need to support other critical services that lawmakers have long described as underfunded, including education, child care, health care, affordable housing and mental health services.

Sen. Roberta Lange (D-Las Vegas), who sponsored the bill, said it represented her vision for diversifying the economy through a sustainable industry to help during the “ebbs and flows” of the Nevada economy, which is heavily reliant on tourism.

Despite an eyebrow-raising price tag on the bill — a cost of $190 million to the state annually, totaling upward of $4 billion in transferable film tax credits over the next 25 years if productions qualify for the maximum amount of credits annually — Lange said lawmakers need to consider the long-term benefits of the program, arguing the return on investment of bringing the film industry to Nevada would exceed the costs.

“We have to have the courage to look past that number,” she told members of the Senate Committee on Revenue and Economic Development.

Proponents’ arguments revolved around three main points — expanding the state’s tax credit program to make Nevada nationally competitive in the film industry, building out long-term studio infrastructure to ensure productions can take place in Las Vegas throughout the year and establishing a workforce pipeline to the film industry through partnering with UNLV and funding education and vocational training programs.

Greg Ferraro, a lobbyist representing Birtcher Development who presented the bill, said a key question is whether the state will lose money because of the program.

“Because of the combined weight of return on investment, net new economic benefits of this infrastructure-based plan, along with film-induced tourism, we argue the answer is no,” he said.

He added that he expects it will take three to five years for the film industry to stabilize in the state, referring to the timelines included in the bill for the developers behind the studio projects to hit certain capital investment goals. That includes $200 million for the Las Vegas Media Campus project and $150 million for the Summerlin project by the end of 2027.

Supporters of the bill — including unions, independent film industry workers and faculty and graduates of UNLV — highlighted the bill’s higher education provisions, which are meant to build out an industry workforce through funding support for related programs at the university.

Despite one backer of the bill (Sony Pictures) being one of the “Big Five” major film studios, Howard Hughes Corp. CEO David O’Reilly said the goal is to create studio facilities that “can accommodate Sony and Universal and Columbia and a number of independent film companies that would like to do production.”

“At the end of the day, any company that wants to do production can come and apply for those credits, and it’s our job to find them space to film,” he said.

An analysis of the proposed annual tax credits prepared by legislative fiscal staff shows the credits could amount to nearly $4.9 billion over the next 25 years, but that amount is based on several assumptions, including a projection of the annual inflation rate and the dates for certain credits to become available based on deadlines listed in the bill.

SB496 would only make $135 million in credits available after certain goals for capital investment at the two studio projects are met. Legislative Counsel Bureau fiscal analyst Michael Nakamoto described the credits as “negative revenue,” meaning they reduce the amount of money the state has to spend in its state budget each year.

Proponents included Ravi Ahuja, chairman of global television studios for Sony Pictures, who said Nevada is well positioned to have a thriving production industry dependent on “competitive” production incentives that are “stable and predictable with enough credits reserved to meet anticipated demand.”

Opponents included representatives from progressive groups, the Nevada GOP and the libertarian think tank group Nevada Policy Research Institute, who criticized giving tax incentives to large companies rather than directing those funds to directly support Nevadans.

“We don't do this for regular people in Nevada, regular people are struggling to buy homes and keep roof over their heads for their families,” Battle Born Progress Executive Director Annette Magnus said. “Meanwhile, we are telling corporations to come here for cheap and we’ll foot the bill.”

Other opponents cited the lack of health care infrastructure to support the anticipated increase in population, expected because the Las Vegas Media Campus is projected to generate 10,000 construction jobs and 16,000 jobs annually after development is complete.

“We've got to start training more physicians, nurses, social workers, psychologists, anything you can think of … we have a pipeline to produce today,” retired psychiatrist Barry Cole said during opposition testimony. “That does concern me. As a psychiatrist, I'm used to dealing with fantasies for a living, but this does sort of worry me that we can't meet current need and we're about to blow up the need we have.”

Those in opposition also pointed to studies showing that the benefits of major film tax credits do not outweigh the costs. That included a 2010 analysis of film subsidies from the progressive-leaning Center on Budget and Policy Priorities, which found that subsidies result in “not much bang for too many bucks.”

Actor Jeremy Renner, who starred as Hawkeye in the Marvel movie franchise and lives in Washoe County, testified neutral on the bill, asking that it include more opportunities for production incentives in northern and rural Nevada. Renner’s Disney+ show “Rennervations” is filmed at the Generator in Reno. He also said major media companies he’s worked with (including Disney) have expressed interest in building out production capabilities in Northern Nevada.

Future amendments and clarifications

During the hearing, presenters noted that an amendment surrounding independent filmmakers would be unveiled in the coming days, though they did not give any additional specifics.

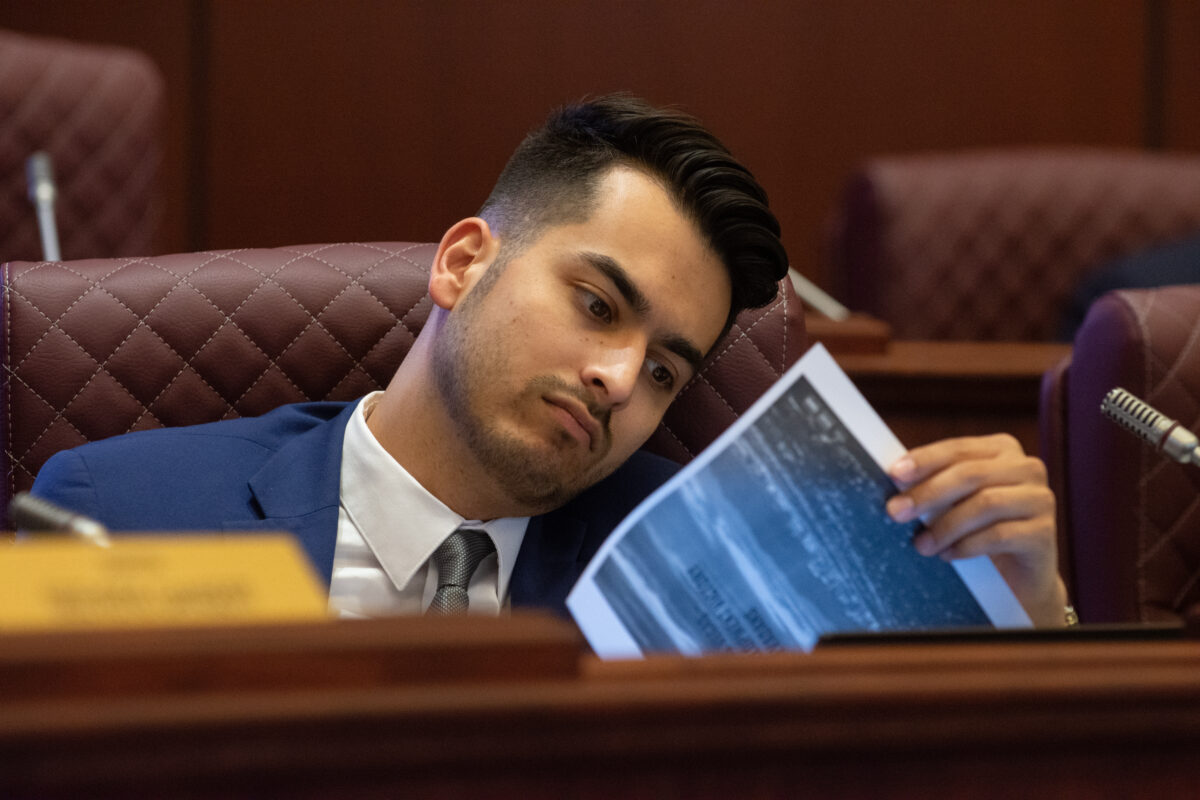

Assemblyman C.H. Miller (D-North Las Vegas), a producer who signed on as a bill sponsor, said he was working to ensure there was support for smaller creators who do not always film in major studios and may produce films in the $1 million to $20 million range.

Presenters also said the amendment would remove a provision from the bill that would make the tax credits refundable, a status that could have forced the state to pay cash to a company with more in credits than they owe in taxes. The credits would still be transferable, meaning a company can sell the credits it receives to other businesses.

One of the clarifications discussed Tuesday included a disincentive in the form of a slight reduction in tax credits for companies that do not hire at least 50 percent of their workers from the pool of Nevada residents. Presenters said the policy on rolling over unused credits (up to 50 percent of annual credits) is still being finalized.

If the bill moves forward, O’Reilly said the Howard Hughes Corp. is prepared to commit $700 million to develop the Summerlin studio project. Brandon Birtcher, CEO of Birtcher Development, the group that would build the Las Vegas Campus Media Project, said the company plans to invest more than $400 million in equity for the campus.

The Birtcher-developed project does not have a publicly announced studio partner as the Summerlin project has in Sony Pictures, leaving the door open for a variety of other types of content creation outside of traditional film and television production, such as video games, he said.

If the proposal moves forward, developers said organizations could enter into investment and development agreements with the Governor’s Office of Economic Development as soon as the fall of 2023. They said construction could begin as soon as the spring of 2025, and assuming an 18- to 24-month construction timeline, tenants could begin occupying space by late 2026 or early 2027 with film and content creation starting in 2027.

“We're proposing to develop, at a cost of almost $2 billion of private capital, two Nevada factories that will produce over a billion dollars of digital content every year, exported around the globe,” Ferraro said.