Indy Explains: The Public Employees Retirement System of Nevada

Comfortable, steady pensions are one of the perks of government work and a rare throwback while the private sector increasingly moves to “you’re-mostly-on-your-own” 401(k)s. But the broad guarantees of such plans, even during downturns, worry critics.

Bad investment years, boosts in benefits during the good times, and people living longer than expected can all swell the state’s unfunded liability — the amount a plan has promised people beyond what it has current funds to pay.

The cost of paying for regular benefits and paying down debt is already a major expense for taxpayers, and if that grows too much, it can eat into other government programs and serve as a drag on budgets and bond ratings.

So how does Nevada’s pension fund work, and how healthy is it? Here’s everything you need to know about the Public Employees' Retirement System of Nevada:

What is PERS?

Created in 1947 as a way to keep up with other states that had been implementing pension plans, the Public Employees' Retirement System promises a lifetime of benefits and includes more than 166,000 contributing members, retirees and beneficiaries. Unlike many private sector retirement plans in which the contribution is set but the payout is uncertain, PERS offers a defined benefit — a predictable payment that’s promised regardless of other financial conditions.

The system is governed by a seven-member board of trustees that includes municipal financing and payroll experts — all of them public employees or retirees themselves. It was designed to be an attractive enough benefit that public employers could retain their workers, reducing the need to constantly retrain people, and to make public employment attractive even if the base pay isn’t always as competitive as in the private sector.

Who is eligible?

PERS serves more than 200 public employers, ranging from city and county government to school districts, public hospitals and special districts like housing authorities. Clark County School District employees account for nearly one-third of PERS members, while state employees are 17 percent and Washoe County School District accounts for 7 percent.

There are several subfunds within PERS: regular beneficiaries, police officer/firefighter beneficiaries, judicial retirees and legislative retirees.

Classified employees within the Nevada System of Higher Education (NSHE), such as support staff, are part of PERS, but employees such as professors are covered with a defined contribution plan. NSHE designed that plan because the portability better fits the needs of professors who are recruited from out of state or will leave the state, while PERS better rewards longevity within the state.

How many people does it serve?

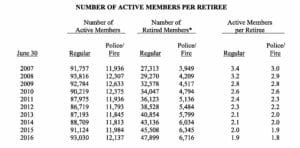

Public payrolls were pared down during the recession, so the number of participants is still below the system’s high point in 2008. By mid-2016, the regular system had 93,030 active members contributing and 47,899 retired members collecting benefits.

The police and fire pool had 12,137 contributing members and 6,716 retirees.

The judicial system, which includes state and municipal judges, had 107 contributors and 70 beneficiaries, while the legislative system — the smallest of all — had 31 contributors and 77 drawing benefits.

The more than 166,000 participants is a big jump from PERS’ first fully active year in 1949, when there were only 3,000 participants and the average payout was $90 a month.

The number of active, contributing members is one indicator of the health of a plan. In 2007, there were 3.4 active members for every retiree. In 2016, that ratio was 1.9 active members per retiree.

How much do retirees receive?

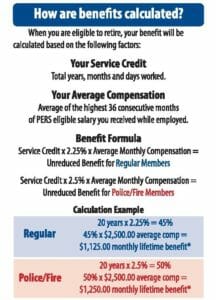

Because it’s a defined benefit plan, retirees are guaranteed a specific monthly payout regardless of how well the system’s investments perform. The payout is a factor of the employee’s number of years in service and the average of the highest three years of PERS-eligible compensation.

Some types of pay, such as overtime, aren’t included in the calculation so it doesn’t overly inflate the payout. Benefits are capped at 75 percent of the employee’s highest average pay, which is lower than the pre-1985 cap of 90 percent.

The average benefit in the regular system is $2,702 per month, while police and fire retirees draw an average of $4,731 per month.

PERS is the main retirement benefit for most recipients because members don’t participate in Social Security. Were Nevada to decide its government workers would join Social Security, it couldn’t get back out, and employers and employees would have to split the 12.4 percent contributions.

“We feel our benefit is more effective with that 12.4 percent than Social Security is,” said Tina Leiss, executive director of PERS.

In all, the system pays an average of about $182 million in benefits each month, or $2.2 billion each year.

Total contributions in fiscal year 2016 increased by $127.8 million or 7.8% to $1.8 billion. Benefit payments for fiscal year 2016 rose by $153.6 million or 7.8% to $2.1 billion, according to PERS' annual report.

At what age can an employee retire and start collecting PERS?

PERS retirees can collect their full benefits earlier than if they were in Social Security, where the current full retirement age is 66 and will soon be 67.

If a regular employee has 33.3 years of service, they can retire at any age and collect their full benefits (under a new tier system for employees hired in mid-2015 and after). If they have 30 years of service, they can retire at 55; if they have 10 years, they can retire at 62, and if they have five years, they can retire at 65.

Police and firefighters have an even younger retirement age. If they serve for at least 20 years, they can retire at age 50.

People who retire early lose 6 percent of their retirement pay per early year.

Proposals to overhaul the system and make it a hybrid, including a bill in 2015 and one proposed this session by Controller Ron Knecht, have called for matching the retirement age with the Social Security retirement age.

The retirement age for PERS is set by the Legislature, while the Social Security rate is set by Congress.

Police and Fire

Police officers and firefighters have a more generous benefit structure than regular employees. They make higher contributions to the fund during their working years — 40.5 percent of their salary, usually paid totally by the employer in lieu of a salary increase — but their years of service pay them out better and they can retire younger.

The official rationale is not to reward them for a hazardous job — it’s to provide the public with “a youthful and vigorous front-line public safety force capable of protecting the public from physical harm,” Leiss said.

Among other perks, police and fire members of PERS don’t have to pay out of their own benefits to have a designated survivor that would receive their benefits when they die. For regular members, having a survivor usually means a trade-off for themselves.

How is the contribution amount determined?

According to Nevada law, an independent actuary must project how much PERS’ investments will make in a given year and how much the system will have to pay out to beneficiaries that year. The PERS board is supposed to set a contribution level every two years based on how much the system needs.

Right now, the contribution level is set at 28 percent of an employee’s salary. Of that, 16.42 percentage points goes to the normal costs of paying benefits, while 11.45 percentage points go to pay down an unfunded liability and 0.15 percentage points go to PERS’ administrative costs.

School teachers and workers at large local governments often have the entirety of their contribution — 28 percent — paid by their employer before taxes. Having the employer pay the full contribution usually means a salary reduction or a lack of a raise to compensate, and the contributions are not refundable if the employee leaves.

In the plan typically used by state employees, workers pay half of the PERS costs while their employer puts in the other half. The employee can recoup the amount they put in if they want to leave PERS, but the plan contributions are slightly higher (29 percent) because of its refundability.

The statutory requirement to set a PERS contribution that’s sufficient to cover PERS’ costs can sometimes be painful, Leiss said. Effective in 2015, the system raised their contribution level from 25.75 percent to 28 percent.

While lawmakers resumed pay increases and ended mandatory furloughs in 2015, those gains were offset by the call to contribute more to PERS. Leiss said the increase came largely because the state didn’t have as many people on its payroll, actively contributing to the plan, as it predicted.

This year, there’s no increase in the PERS contribution.

Critics at the Nevada Policy Research Institute, a libertarian think tank, say contributions should be higher to put the plan on more solid footing to brace for lackluster investment years. They assert that PERS board members, who are public employees themselves and must answer to their coworkers, haven’t mustered the political will to raise contributions to prudent levels.

According to a one-time independent comparable study performed by Aon Hewitt in 2013 and cited by the Legislative Counsel Bureau, the PERS police/fire contribution rate, then at 20.25 percent, was the highest contribution rate charged to members in a survey of 126 public pension plans, and the contribution rate of regular members of PERS was the third highest at 12.25 percent. Part of the reason the contributions are relatively high is because PERS members aren’t using Social Security.

Raising the contributions any higher would be a tough decision. A recent move in California to lower pension investment return expectations will add strain on members and employers who must contribute more to compensate.

“There are significant fiscal ramifications if the board would do that,” said Republican Sen. Ben Kieckhefer, past chair of the legislative board that gives oversight to PERS. “We have to be very cognizant of that because it significantly affects how much the state and the members would have to pay into it.”

Unfunded liability

By mid-2016, PERS had $34.6 billion in investment assets but owed $12.56 billion more in future benefits than that. That gap between money owed and money on hand is called an unfunded liability, and is one of several key indicators of the health of a pension.

The unfunded liability for the plan increased slightly from 2015, when it was $12.35 billion.

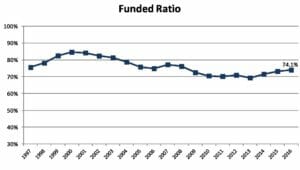

PERS is now 74.1 percent funded, meaning it had about three-quarters of the money needed to pay off its total obligations. That’s an improvement from 73.2 percent a year earlier.

That “funded” percentage dipped and unfunded liabilities grew during the recession but have somewhat recovered as investments grow.

PERS is making payments toward the unfunded liability that are expected to pay it off in 20 years, if the system fulfills its predictions and if the Legislature doesn't change the benefits structure.

Is having an unfunded liability healthy?

An unfunded liability is common — it happens when the state doesn’t hit its assumptions (projections) on when beneficiaries die, how many leave the fund before they “vest” (are in it long enough to be eligible for benefits), what their salary increases will be and how many active, contributing employees are on the payroll.

There’s a general understanding that a public pension plan that’s at least 80 percent funded is healthy, although the American Academy of Actuaries has cautioned against leaning too much on that figure and recommended everyone aim to attain and maintain a funded ratio of at least 100 percent over a reasonable period of time.

Numerous factors play into the unfunded liability figure. The first is investment returns — pension funds all over the country took a dive when the recession hit. Another is about how accurately actuaries predict how much the fund will have to pay out.

Policy changes also alter PERS’ liability. For example, Leiss said that in the 1980s, PERS’ “funded ratio” dropped to 55 percent. That was because lawmakers decided to institute a plan for post-retirement pay increases.

It came at a time when inflation was much higher than it is today, and lawmakers wanted to ensure employees’ pensions reflected the rising cost of living, even if it increased the fund's obligations.

The unfunded liability figure represents how much the state would have to pay out if for some reason, the government were to stop all operations at once and need to settle current and future debts to all PERS participants immediately.

Because that situation is unrealistic, and government is expected to go on forever, there’s a range of opinions on how concerned Nevada should be about its unfunded liability. Some Republican lawmakers say it’s not cause for alarm, but needs to be managed so it doesn’t snowball and so debt service doesn’t start taking away too much money from other programs

“I feel comfortable that it’s growing. In my mind that’s too low,” Kieckhefer said about the 74.1 percent funded ratio. “The prospect of unfunded liability for the state for PERS is not necessarily troubling but something you need to address.”

Democratic Senate Majority Leader Aaron Ford said he’s pleased with how PERS is doing and doesn’t support legislation overhauling the system.

“It’s entirely satisfactory,” Ford said of the funded ratio. “I think if you talk to experts in our caucus and experts throughout the state, you’d hear them report on the positive nature of our situation, especially compared to other states.”

How are PERS' investments?

The return on PERS' investments were 2.3 percent in fiscal year 2016, lower than the target 8 percent. But numbers have been higher in recent years: it was 4.1 percent in 2015, 17.6 percent in 2014, 12.4 percent in 2013, 2.9 percent in 2012 and 21 percent in 2011.

Net investment income was $0.8 billion in fiscal year 2016, as compared to the $1.4 billion income generated in fiscal year 2015, according to PERS’ annual report.

The fund has also done well from the recent stock boom following Donald Trump’s election. In the past few months, the trust fund has grown by $2 billion, according to PERS officials.

NPRI has questioned the wisdom of PERS predicating its strategy on 8 percent investment returns. The group points to a scenario from a PERS consultant that predicted dire straits for the fund if its investment returns dropped to 5.85 percent, and notes that Warren Buffett recommends assumptions of 6.5 percent.

PERS points out that over the last 32 years, it’s had an annualized rate of return of 9.4 percent — higher than the 8 percent objective. Both sides concede that nobody knows how the markets will perform in the future.

The system's portfolio is managed by nine external investment managers. With the US stocks, the managers “index” the funds, meaning they try to match the returns of the S&P 500 instead of actively managing them in an attempt to beat the stock market.

As a result of the indexing — which is somewhat unique among state pension funds — the state pays 0.11 percent in fees, much lower than the rate it would pay if it were actively managed.

The fund aims for the following asset mix: US stock: 42 percent, international stock: 18 percent, US bonds: 30 percent, private equity: 5 percent, real estate: 5 percent.

Nevada expects at some point that it would need to dip into its trust fund to pay out benefits, but because of positive cash flow, isn’t having to do that right now.

That gives the fund the flexibility to invest in less-liquid, potentially higher-yield assets, unlike other funds that are on the verge, are actively tapping into their trust funds and thus must invest more conservatively.

Guarding against political manipulation

Projections about the long-term health of a pension can look rosy or apocalyptic depending on the assumptions that go into them. Someone could distort the state of the fund by projecting unrealistic 10 percent returns on investment and make the politically popular move of reducing contributions, saving employees and the state huge sums of money in the short term.

But if that prediction is wrong, and investments far undershoot it, the pension fund would be badly destabilized and underfunded.

That’s why Nevada has protections in place to guard against politically motivated manipulation of PERS’ financials. A constitutional amendment proposed in the mid 1990s by then-Assemblyman Dean Heller and then-Assemblywoman Marcia de Braga strived to remove pension funding from the political sphere, giving the Legislature the authority to design the benefit structure, putting a PERS board in charge of managing the system and requiring the PERS board to base its actions on the advice of an independent actuary.

The agency itself is considered a non-executive branch agency, so the PERS executive director can be fired by the board but not by the governor or the Legislature. Still, the governor and the Legislature have influence in other ways — the governor gets to appoint members of the PERS board and lawmakers have oversight through the Interim Retirement and Benefits Committee.

An independent PERS is important for another reason: the state is one of the participants in the program but so are some 200 other employers such as local governments. Removing some executive branch influence helps ensure the state doesn’t have too much of an advantage over the other employers in decision-making.

Preventing creative accounting

In another effort to increase transparency, the Governmental Accounting Standard Board (GASB) recently changed the rules on how pensions report their funding. Governments previously “smoothed” their results — averaging their investment returns over a multi-year period, for example — in ways that obscured dips and downturns and could make returns look better than they actually are.

PERS still uses a smoothed figure in calculating the size of contributions every two years because it doesn’t want the contribution size to vary too widely.

But it also reports figures that aren’t smoothed and are based on “market value.”

There’s also a move to have pension funds make more conservative predictions about their future investment returns, especially if they’re not well-funded. That’s to protect against pension managers making pie-in-the-sky predictions about how they’ll be able to pay back huge debts through great investment returns.

Transforming PERS to a hybrid plan

Worried that the unfunded liability is an unsustainable weight on the taxpayer and forebodes a future crisis, officials — mainly Republicans — have sought to restructure PERS over the years.

Gov. Brian Sandoval proposed a plan in the 2011 session that would have switched the state to a hybrid retirement system. The issue didn’t get traction that year, but was a major point of discussion in 2015 in the Republican-controlled Legislature when then Assemblyman Randy Kirner introduced AB190.

The bill called for Nevada employers to put their new workers on a hybrid model that had elements of the traditional pension plan and elements similar to a 401(k). Kirner argued that the bill would reduce costs for employers, and thus taxpayers, and would boost returns for employees.

It attracted fierce opposition from PERS officials and unions, who said it would reduce benefits for retirees, and it ultimately died when officials said it would cost more than $800 million to implement.

PERS officials said the hybrid model would not get rid of the system’s unfunded liability, but would create a pool of participants that’s increasingly full of retirees and is getting no new money. The $800 million price tag reflects the cost of paying off that unfunded liability while transitioning to the new model.

NPRI disagrees with the price tag, saying the system could pay off the unfunded liability over a longer period of time rather than in an intimidating lump sum.

Republicans aren’t giving up on the idea. Knecht is sponsoring a bill, AB71, that would implement the hybrid system, but PERS has once again added a hefty fiscal note to it.

Democratic Assemblyman Edgar Flores, who chairs the Government Affairs Committee that now has the bill, said he’s not sure if it will get a hearing. Other Democrats were more certain that they wouldn’t entertain the idea.

“Absolutely not. They’re wasting their time,” Ford said about considering a hybrid plan. “We made great strides in protecting our system and we’re not going to be taking steps back by these right-wing approaches to try to quote unquote fix PERS. It’s not a broken system.”

More modest changes

While legislative Republicans failed to pass a sweeping PERS bill in 2015, they did come up with a compromise bill, SB406, that had more support from unions and is expected to save more than $1 billion over the next 10 years.

The bill reduces benefits for people hired on or after July 1, 2015. While regular employees had previously received 2.5 percent of their salary for each year of service, the new hires will now receive 2.25 percent of their salary for each year of service.

Post-retirement increases are also newly limited by the Consumer Price Index, and the PERS payouts can be based on salary of no more than $200,000 annually.

It also terminates pensions for public employees who are convicted of bribery, embezzlement, theft of public money, perjury or conspiracy to commit any of those crimes.

And it adds benefits to a spouse or other survivor if a member dies in the line of duty, in the course of employment judicial or legislative service. It also makes permanent the critical labor shortage, which allows retired people in high-demand jobs to return to public service without forgoing their pension.

Sandoval, who supported a hybrid plan in 2011, didn’t comment on whether he still thought that would be the best course of action now.

“It’s not that black and white,” he said last week. “I know that you shouldn’t give short shrift to what we did in 2015 because I think it’ll have very positive consequences in regards to the strength of the PERS system.”

PERS compared to other systems

The Urban Institute gave Nevada’s pension system a C grade in 2014. The state does a good job at ensuring it’s making the contributions it should to pay off its unfunded liability and finance benefits, but it scores low on metrics such as encouraging people to work at an older age.

A Pew report from 2014 analyzed net amortization, which "measures whether total contributions to a public retirement system would have been sufficient to reduce unfunded liabilities if all expectations had been met for that year." Nevada isn’t as bad as Kentucky, New Jersey, Illinois, Pennsylvania and California, but is also far from the “positive amortization” that 15 other states have achieved.

"Plans that consistently fall short of this benchmark can expect to see the gap between the liability for promised benefits and available funds grow over time," the Pew report says.

The Stanford Institute for Economic Policy Research ranked Nevada PERS’ debt in 2015 on a variety of metrics. The state ranked at or near the top in terms of pension debt compared to how much it spend overall with its general fund, but was in the middle of the road on the size of its unfunded liability.

This story was updated at 5:10 p.m. on Feb. 19, 2017 to clarify that retirement ages mentioned apply to people hired in mid-2015 and after. People hired before that have slightly different full retirement eligibility ages.