Indy Gaming: Is the Strip headed for its first revenue decline since the pandemic?

Is the Strip’s post-pandemic gaming revenue run ending? Statewide gaming is up but volatility in revenue from baccarat could keep Strip resorts from matching 2023’s revenue record.

Meanwhile, the landowner for the planned A’s ballpark responds to speculation that it’s kicking in money for the project.

Programming note: Indy Gaming will not be published next week due to coverage of the 2024 election. The newsletter will return Nov. 13.

Please click here to sign up for Indy Gaming.

Lucky streaks by big-spending baccarat players who wager from eight-figure accounts they deposit in a casino cage can flip the fortunes of an entire market.

That could be the cause of a nearly 2 percent gaming revenue decline on the Strip in September — the fifth gaming loss for the market in the first nine months of 2024.

State gaming regulators said Tuesday the Strip’s year-to-date total is down a minuscule 0.2 percent through September. But the resorts face ominous signs in their quest to match or exceed 2023’s single-year gaming revenue record of $8.9 billion.

It all depends on high-end baccarat, where one or two big spending casino customers can alter the hold — the percentage of the game’s wagers held by the casino — and greatly lower the revenue totals. The lower the hold percentage, the lower the casino revenue.

In September, a lower hold percentage caused baccarat revenue to fall 40 percent compared with a year ago, driving down the Strip’s overall revenue total to $727.7 million. Absent baccarat, Strip gaming revenue would have increased 7.6 percent.

“The last three months do not get any easier,” cautioned Michael Lawton, the Gaming Control Board’s senior economic analyst.

Looking ahead to the Strip’s fourth quarter, he noted revenue rose 11.5 percent year-over-year in 2023 — including December’s single-month record of $909.6 million.

“The point I am driving home is the comparison stack is extremely challenging and is being driven by above-average baccarat hold percentages,” Lawton said. Casinos held 17 percent of all baccarat wagers during the month compared with 22 percent in September 2023.

The event calendar in November and December — including the Formula One Las Vegas Grand Prix, Las Vegas Raiders and college football games at Allegiant Stadium and the National Finals Rodeo — matches up with 2023.

However, last year also included the opening of the $3.7 billion Fontainebleau Las Vegas and performances by legendary rock band U2 at the 2-month-old, $2.3 billion Sphere in Las Vegas, both of which helped drive high-end gambling.

“The wild card is the baccarat hold percentage and that will determine the Strip’s ability to beat 2023,” Lawton said.

Macquarie Securities gaming analyst Chad Beynon agreed with Lawton’s assessment, saying the event calendar, combined with group travel, would help boost the resort industry’s non-gaming revenue, including hotel rooms and restaurant spending.

Meanwhile, Las Vegas visitation continues to climb. The Las Vegas Convention and Visitors Authority said Tuesday the market drew slightly fewer than 3.4 million guests during September, a 1.6 percent increase from the previous year — boosted by a 29 percent jump in convention attendance. For the year’s first nine months, visitation is up almost 3 percent.

Beynon said any slowdown in leisure travel could lead to a more competitive promotional environment with Strip resorts offering discounts and other incentives to bring in customers. That was the case in September when average daily room rates fell almost 3 percent on the Strip to $209.58 and 11 percent in downtown to $107.25.

Statewide, gaming revenue topped $1.3 billion, a 3.3 percent increase from 2023 and bouncing back from a nearly 4 percent decline in August. Through September, Nevada's gaming revenue is pacing 1.2 percent ahead of 2023, which set a record of $15.5 billion over 12 months.

J.P. Morgan Securities gaming analyst Joe Greff blamed the calendar for skewing the totals higher this month because August ended on a Saturday, sending the slot machine results into September.

The Boulder Strip, which includes casinos along the Boulder Highway and in Henderson, bounced back to a 19 percent revenue increase in September following a nearly 22 percent decline in August. Downtown casinos grew revenue by 33 percent in September after a nearly 9 percent drop in August.

“[It’s] a quirk in Nevada reporting,” Greff noted. Table game wagering and revenue were unaffected by the calendar oddity. Slot machine wagering, however, is recorded electronically.

Lawton made one prediction — he expects the state to finish ahead of 2023’s single-year record of $15.5 billion due to the balance of Clark County. The market, which covers casinos in unincorporated regions but excludes the Strip, has seen gaming revenue increase almost 12 percent through September. The area includes the $780 million Durango Casino & Resort, which opened last December.

Landowner of A’s stadium site won’t provide team financing

Gaming and Leisure Properties President Brandon Moore cleared up any misconceptions about the company’s intentions on financing the development of its 35-acre Las Vegas Strip parcel where a new baseball stadium will be built.

The Oakland Athletics are on their own in financing a $1.5 billion Major League Baseball stadium that will take up 9 acres, Moore said.

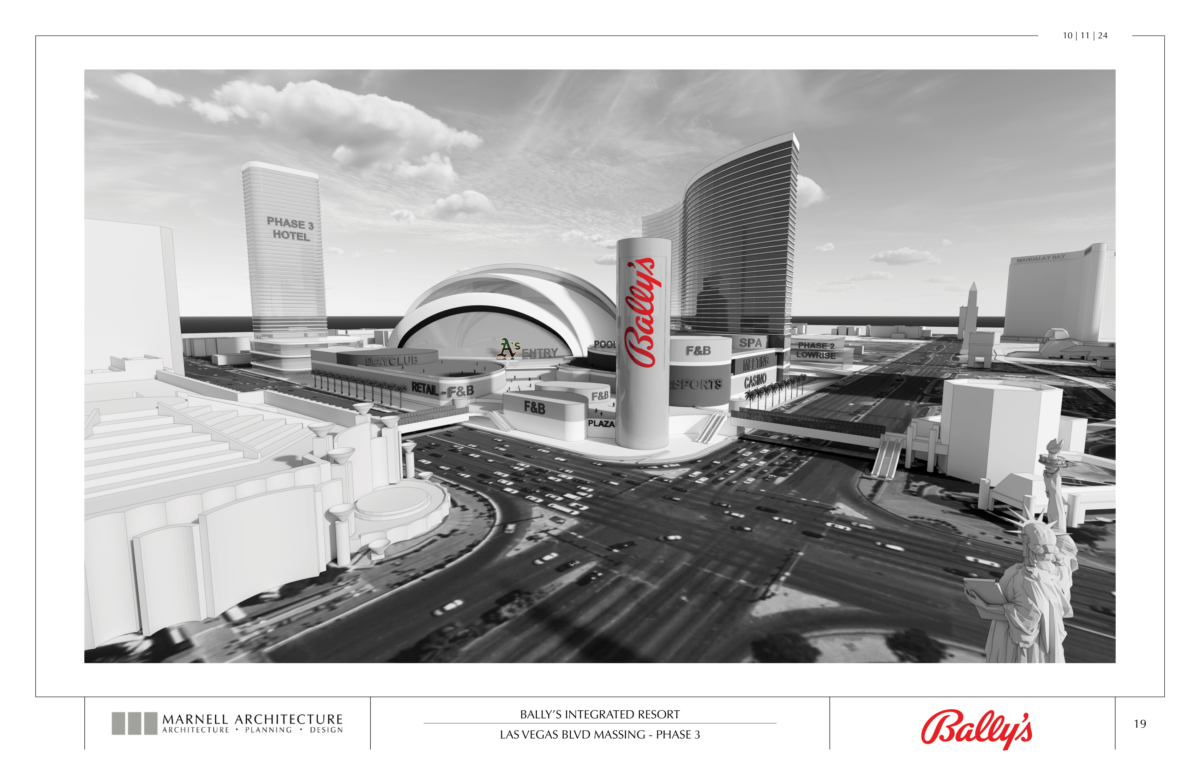

Meanwhile, Bally’s Corp., which operated the since-demolished Tropicana Las Vegas but continues to lease the site from Gaming and Leisure for $10.5 million a year, unveiled plans to build an integrated resort on the remaining land.

Gaming and Leisure will determine its role at a later date.

Moore said the initial plans submitted to Clark County by Bally’s and the A’s for review earlier this month were the just initial step in the process. He said the outcome of that review would determine “how much, if any, additional dollars we're either asked to provide, or more importantly, willing to provide to support the construction of the integrated resort.”

Ahead of the Oct. 9 implosion of the Tropicana, Moore said there were funds left over from the Pennsylvania-based real estate investment trust’s $175 million commitment toward its demolition that could be used to help develop the site’s non-stadium aspects.

As Atlantis room remodel nears completion, what’s next for Reno-based Monarch?

Monarch Resorts expects the renovation of more than 800 hotel rooms at Reno’s Atlantis Casino and Resort to be completed early next year, which company officials said would increase the average daily room rate by $20 to $25 a night.

So what does the future hold for the Northern Nevada-based company that also owns a casino in Black Hawk, Colorado, that continues to expand its reach into Denver?

“Monarch continues to hold a best-in-class portfolio, but investors continue to ask for the ‘what's next,’” Macquarie Securities gaming analyst Chad Beynon wrote in a research note last week. “We believe Monarch remains well positioned for another opportunity.”

He and other analysts believe Monarch has enough funds on the balance sheet to grow by adding a third property.

However, Truist Securities gaming analyst Barry Jonas noted that the company was focused on reducing costs at Atlantis given the challenges the property faces from elevated promotional spending by Reno-area rivals and tribal casinos in Northern California.

What I'm reading

✈️ Activist investor Elliott wins Southwest board seats amid feud — Alison Sider, The Wall Street Journal

The largest carrier at Harry Reid International Airport will get six new board members and the CEO will remain in place.

🛋️ From showgirl feathers to shimmering chandeliers, casino kitsch finds new life — Rio Yamat, The Associated Press

Millions of big and small items from the closed Tropicana and Mirage were meticulously sorted, sold, donated and discarded.

💬 Delta CEO will keynote the CES tech show from Las Vegas’ glitziest stage — Kelly Yamanouchi, Atlanta Journal-Constitution

The Jan. 7 talk will focus on the airline’s “vision for the future of travel” and take place at the $2.3 billion Sphere in Las Vegas.

News, notes and quotes

🎰 Aristocrat earns first slot provider license in UAE

Aristocrat Gaming is the first slot machine provider awarded a gaming license in the United Arab Emirates. The license granted by the General Commercial Gaming Regulatory Authority comes after Wynn Resorts was licensed by the authority earlier this month to operate a casino at the $5.1 billion Wynn Al Marjan Island in the emirate of Ras Al Khaimah. Aristocrat said the license will allow the company to provide gaming to commercial operators licensed by the authority.

💻 Sands CEO critical of New York casino licensing process

Las Vegas Sands CEO Rob Goldstein has been frustrated by delays in the selection and licensing process for one of three casinos near New York City. Sands wants to build a $6 billion integrated resort in Nassau County on Long Island. Goldstein said last week it may take until early 2026 for the process to be completed. A new wrinkle concerns New York exploring the legalization of online casino gaming.

“You can't ignore what's happening in New Jersey, Pennsylvania and Michigan,” Goldstein said of the three largest online gaming states. “We build capital-intensive buildings that require a long-term perspective. The online impact is a concern and it's something I've been looking at closely.”