Inflation and investors challenge residents in volatile housing market

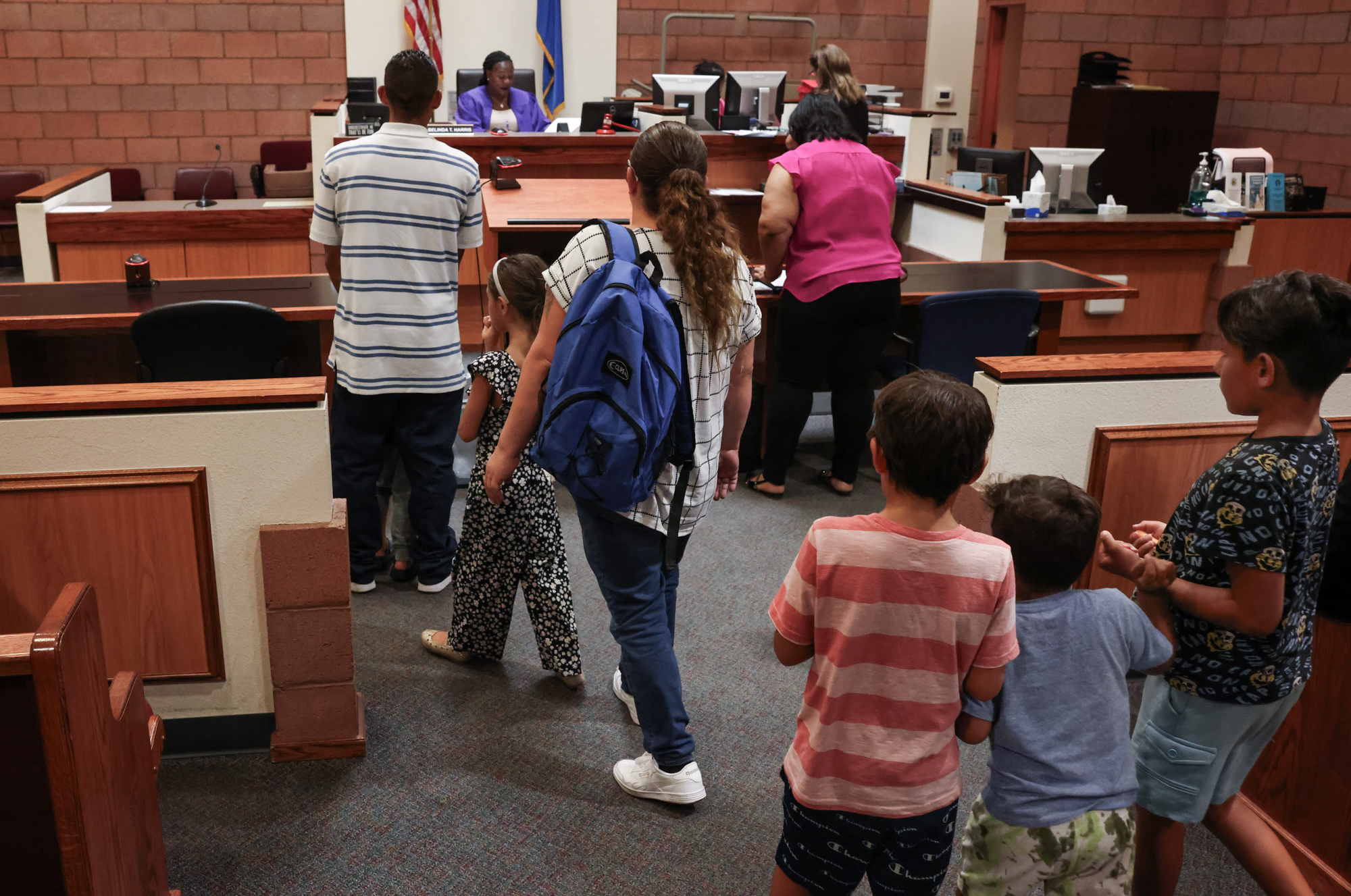

A befuddled Lashanda Davis, 47, walked out of a busy North Las Vegas courtroom last Tuesday after representing herself against a civil lawsuit seeking claims of property damage totaling more than $9,500. She had lived in the home with her six children for five years, and was in court to dispute the amount requested, stating that it was “entirely too much.”

When her property manager declined to renew her lease in March, Davis said she struggled to find housing without a rental ledger from the leaser, a document used to show proof of no wrongdoing or money owed. Without the necessary documents to transfer her Section 8 housing, she and her children lived out of a car for a few days and then temporarily lodged with family members in Chicago until securing housing in Las Vegas in early May.

“Premiere Holdings refused to give me [a ledger],” Davis said in the hallway outside of the courtroom. “As of March 18, when I turned in my keys, I still hadn’t got anything. I still, to this day, haven’t gotten a ledger. All I got is what I owed for damages.”

Davis said fighting this lawsuit, which caused her to miss days of work, makes her feel hopeless and she fears that tenants have no personal rights when it comes to corporate landlords overcharging for fees and fines in rental agreements.

Housing lawyers and researchers recommend policy changes that would help balance the power of investors through legislation and increase funding for low and moderate income households, especially in a market where demand is high, supply is low and tenants are not guaranteed legal representation in these disputes.

“We need more transparency in rental applications and the fees that people are assessed,” Rep. Steven Horsford (D-NV), who observed the court proceedings last Tuesday, told The Nevada Independent. “Even in eviction proceedings, you tend to see them stack up these fees and fines to the point where it’s totally unmanageable for someone. And it’s overwhelming, really, for them.”

A spokeswoman from Summerlin-based real estate group Premiere Holdings testified to North Las Vegas’ Justice of the Peace Belinda T. Harris that the amount Davis owes includes the cost to replace the stove and refrigerator, which she said has a dent in it and “looks like a punching bag,” laminate flooring that was damaged by water, a hole in a wall that is larger than a piece of paper and unkept landscaping.

Harris ordered both parties back to court on Aug. 28 after the landlord failed to produce a ledger. Rent ledgers are used by landlords and property managers to track rental rates, late fees and outstanding balances, as well as the lease agreement.

Davis said she never faced these kinds of difficulties with rental agreements until moving to Las Vegas from Chicago five years ago, following the advice of her surgeon. She was told by physicians in 2018 that she could better manage back pain stemming from surgery by living in a warmer climate.

“When they tried to sue their insurance company, the insurance even said that this is wear and tear,” Davis said of Premiere Holdings. “The flooring. Again. I get it … but it’s laminate, the stuff that you paste on the floor. And we went through a major pandemic. So you think I wasn’t mopping with bleach?”

Davis said she believes she is no longer wanted in the home because she fell two months behind on rent in December and January, owing about $5,500 which included a “substantial” amount of fees. But that amount was paid off in April with the help of the Clark County Cares Housing Assistance Program (CHAP). She was paying $1,200 of the $2,000 monthly rent for a five-bedroom home in North Las Vegas, with Section 8 covering the rest.

“I’m gathering, just from what happened to me, that because I moved out, I have to make [the house] ready for the next tenant,” Davis said.

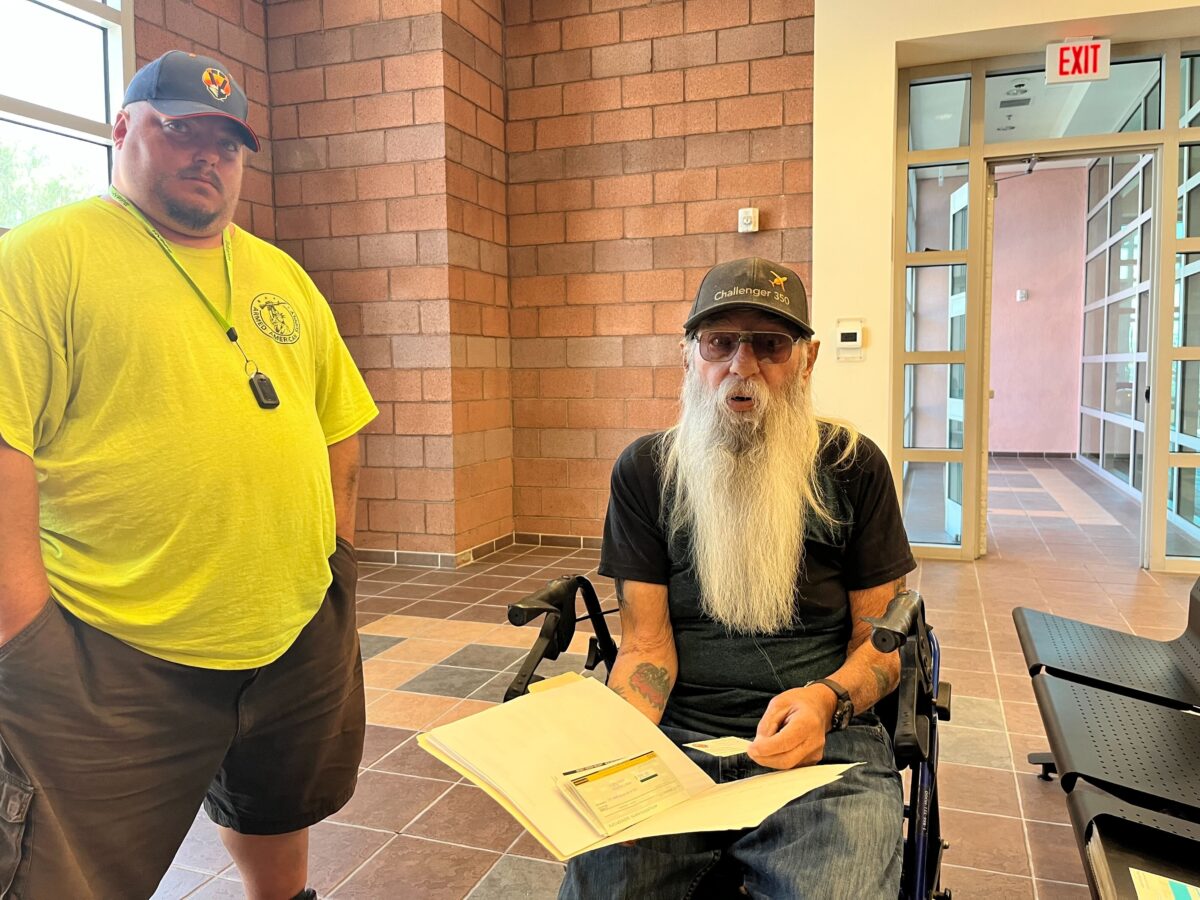

After Turn Key Property Solutions failed to produce a ledger for Michael Baumwell, 76, the company is also due back in court. The local real estate firm manages the individually owned Craigmont Villas at Craig Road and Nellis Boulevard in Las Vegas, where Baumwell lives. Baumwell is disputing his rent amount, alleging that the monthly rate includes the cost of appliances such as the refrigerator.

“I’ve been renting almost 60 years, in three different states,” he said. “If the appliance is in the apartment, it comes with the apartment.”

Baumwell said his rent is $915 a month and he owes more than $4,300 in back rent after refusing to pay the total price for a year, questioning the legality of his rental agreement.

He also said communicating with property managers is a struggle because most things are online and he is computer illiterate. He also said the onsite office is difficult to access, hard to find and that the staff is unhelpful.

“Before I even moved in, I let them know I’m on Social Security retirement and that I get paid every third of the month,” he said. “They want their money on the first of the month, and their [advice] is, ‘pay it in advance’ [to avoid late fees that are accrued after 5 p.m. on the third].”

Turn Key Property Solutions and Premiere Holdings did not respond to requests for comment.

Investors target low income neighborhoods

With supply chain issues, rising costs, land restrictions and affordable housing shortages — especially for Southern Nevadans who earn about $49,000 or less in gross income for one person, or $69,000 for four people — many residents find themselves being priced out of the homebuying process by private equity firms and turn to rental housing. Data analyses by the residential real estate brokerage firm Redfin indicates that investors purchased more than 80,000 homes worth $50 billion across the U.S. in three months during 2021, increasing corporations’ market share to 18 percent.

Rental rates also skyrocketed nationwide following the pandemic, which led some state officials and national leaders to believe that some “corporate entities” added another bite — through price gouging in the housing market — to the calamities experienced by residents struggling with inflation, a global catastrophe and severe unemployment.

“Understand that people have been through a lot over the last few years with the pandemic and the economic downturn,” Horsford said. “We’re coming out of that, but we just need to give people time to breathe, to get caught up and to be able to keep a roof over their heads.”

Real estate analysts warn that the housing supply crunch puts buying power in the hands of investors who purchased 75 percent of their homes with cash across the country in 2021, per Redfin data.

In Southern Nevada, investment home purchases increased 105 percent in 2021 year over year, making up 30 percent of sales. Housing experts explain that this often leads to increased rental rates, especially for single-family rentals, as investors go after profits, some as publicly traded real estate companies.

Rutgers University housing researcher Eric Seymour’s article, “Our Customer Is America”: Housing Insecurity and Eviction in Las Vegas, Nevada’s Postcrisis Rental Markets, based on a study from 2008 to 2019 — which is propped up against a backdrop of low-income housing shortages — showed that increased corporate transactions in the housing market resulted in higher rents and acquisition costs because of “intense competition” and a need for capital returns.

Horsford said it’s difficult to intervene in tenant-landlord disputes, such as rental abuse, the rate of evictions and poor maintenance on properties because they’re owned by private equity companies.

Seymour’s research supported this claim, showing that in highly sought-after “Sun Belt metropolises” corporate landlords were more likely to delay maintenance and security deposits but “deliver evictions with great speed” because many of those services are automated.

The study also found that local large operators, such as King Futts and Single Family Rental Investments Pool, fell within this framework, “offering tenants slightly lower-cost rental homes in exchange for poor and worsening housing conditions.”

“We have to have a conscience in what we’re doing and how we’re doing it,” Horsford said. “We have to have a process that is fair and equitable, and doesn’t target communities like in North Las Vegas where [housing instability] disproportionately affects women and people of color.”

Horsford, who is chair of the Congressional Black Caucus, introduced the HOME Act (Housing Oversight and Mitigating Exploitation Act) in Congress in July 2022, which would authorize the Department of Housing and Urban Development to carry out investigations and fine corporate investors for overcharging and targeting Black, Latino and single-parent renters. The policy was referred to the House Financial Services Committee and has not received a hearing.

The measure was introduced a month after the House Committee on Financial Service sent out a memo with recommendations aimed at shaping how companies manage single-family rentals. The directive was based on research by the Brookings Institution Center on Urban and Metropolitan Policy, which found that corporate housing investors often seek purchases in low-income neighborhoods, minority communities and areas with high rates of single-parent households, a method that exacerbates the racial wealth gap through buying power by outbidding Black and Latino first-time homebuyers.

Housing researchers from the centrist think tank Brookings Institution found that after “institutional investors” buy up homes in a neighborhood, they “subsequently see higher rates of eviction and greater loss of Black residents.”

“Congress has several channels to relieve financial stress on renter households and lower barriers to first-time homeownership,” wrote housing scholar Jenny Schuetz in the memo. “The most direct, straightforward way to help low-income households afford decent-quality housing and accumulate savings is to give them money.”

Money in this case means funds that would support financial stability for “low- and moderate-income households” through housing vouchers, child tax credits or earned income tax credits that are distributed monthly instead of annually.

During the recent state legislative session, Democratic legislators passed several bills aimed at addressing the housing crisis that were ultimately vetoed by Republican Gov. Joe Lombardo. One of those vetoed bills is SB78, a measure sponsored by Sen. Fabian Donate that would have outlawed certain fees charged by landlords, established penalties for unscrupulous activities, mandated certain disclosures and required advance notices for rent increases to uphold transparency and accountability among real estate professionals.

“This bill would make wide-ranging changes to accounting practices, traditional fee collection, certain disclosures, and various notice requirements with which lessors in new agreements would be immediately forced to comply at the risk of sustaining penalties,” Lombardo wrote in his veto message. “Since this bill would only serve to exacerbate an already challenging period for [Nevada’s] renting families, I cannot support it.”

Corporate transactions

The Washington Post found that investors targeted certain areas for getting a return on their investments. The paper’s research showed that the highest concentration of home purchases by investors took place in predominantly Black neighborhoods because they have been historically undervalued. The investors would buy homes for low prices and then flip or rent the homes at higher prices. In 2021, across 40 large cities, an average of 30 percent of investor purchases took place in Black neighborhoods, compared to 12 percent in other ZIP codes.

Horsford said a crash may be coming and would look different from the housing collapse of 2008 when people owed more on their homes than what they were worth. He said this time the pending collapse is the result of people falling behind on rent because the cost of housing is not affordable, which housing policy researchers said “consigns” low and moderate-income households “to the margins of the private rental market.”

“We have known and were concerned about the housing crisis before the pandemic, obviously, during the pandemic and coming out of the pandemic,” Horsford said. “People told us that this is just ballooning and that it is ultimately going to crash.”

He said after reading an analysis by The Washington Post that showed that the Las Vegas Valley experienced a 9 percent increase in corporate home buying in 2021 compared to 2015, he wanted to do something to safeguard constituents from “market manipulation.”

Market manipulation is defined by Market Business News as artificial representations of supply and demand that tips the market into the favor of investors.

The journalist-led analysis found Southern Nevada in the top 10 “typical metropolitan cities” for investment home buying activity, with 18 percent of homes purchased by corporate entities, compared to the top cities — Atlanta, Georgia and Charlotte, North Carolina — where a quarter of the homes sold were to investors.

Some ZIP codes in the Las Vegas Valley reached 26 percent, such as 89032 (an area in North Las Vegas between Lake Mead Boulevard and Craig Road, spanning from Rancho Drive to roughly Martin Luther King Boulevard and North Fifth Street), 89104 (a strip of land that runs from Commerce Street to Nellis Boulevard, between Sahara Avenue and Charleston Boulevard) and 89179 (a neighborhood located near the corner of Cactus Avenue and Rainbow Boulevard), and the highest was 89159, an area on Eastern Avenue and Sunset Road, near Sunset Park, where 30 percent of homes were purchased by corporate entities.

The data showed a pretty expansive corporate home-buying presence in Las Vegas, with many ZIP codes at 16 percent or more. Detroit, Michigan, saw a similar situation, with 19 percent of homes purchased by corporations. However, in certain ZIP codes, especially the inner city, 45 percent to 82 percent of the homes were purchased by investors.

“[Las Vegas] is a hot [market],” Horsford said. “We have all these sports teams, and Formula One and the Super Bowl — all of that is driving up costs for everybody but especially for those who need affordable housing.”

Support Local Journalism

You’ve enjoyed unlimited access to our reporting because we’re committed to providing independent, accessible journalism for all Nevadans.

But sustaining this work — informing communities, holding leaders accountable, and strengthening civic life — depends on readers like you.

Nevada needs strong, independent journalism. Will you join us?

A gift of any amount helps keep our reporting free and accessible to everyone across our state.

Choose an amount or learn more about membership