California sports betting: Competition or opportunity for Nevada?

The question has confounded the Nevada gaming industry since the mid-1990s.

Does gaming expansion in neighboring California pose an economic threat to the state's casinos?

California voters, who approved tribal casino expansion in 1998, will have another chance to weigh in on the Golden State's gaming future in November.

The choice could consist of three ballot questions to legalize sports betting. The initiatives have different support groups and provide various wagering options.

A coalition of nearly two dozen tribal casino operators wants approval for just retail sportsbooks inside their properties. Seven of the nation's largest sports betting operators, meanwhile, are backing a referendum to allow mobile and online sports betting. Three other tribal casinos are pushing a mobile sports betting bill that would allow the tribes to operate the activity while prohibiting the inclusion of out-of-state sportsbook operators.

California, with a population of nearly 40 million, is the largest of the 17 states still without legal sports betting. According to the American Gaming Association, it is one of 11 states with either pre-filed legislation or a pending ballot question related to expanded sports betting.

Sports betting proponents predict big dollar signs for the Golden State, but if history repeats itself, that may not spell doom and gloom for the Silver State's gaming cash flow. Nevada gaming companies are largely staying out of the fray — at least for now — and analysts are not sounding alarm bells yet. After all, Nevada has seen gaming proliferate beyond its borders for years now.

B Global Managing Partner Brendan Bussmann called Nevada a "one foot in the grave state" whose demise was often predicted during different waves of nationwide gaming expansion.

"New Jersey was going to kill us. The expansion of sports betting was going to kill us. Online gaming was going to kill us. We are still kicking and seeing record revenue," Bussmann said of Nevada's record-shattering $13.4 billion in gaming revenue in 2021.

"The experience of Las Vegas cannot be matched, and so people will still come to Nevada and partake in sports betting," he said.

'I've quit betting against Nevada'

The retail sportsbook initiative backed by tribal casino operators qualified for the Nov. 8 ballot last year. The mobile betting initiative backed by sportsbook operators reached 25 percent of its required signatures in January. The tribal mobile betting measure hasn't yet achieved the 25 percent mark.

The two remaining petitions need to be filed with the secretary of state's office by the end of April to make it on the 2022 ballot.

Nearly 80 tribal casinos operate in California and produce, by recent estimates, a U.S.-leading $9 billion a year in annual gaming revenue. California is home to multiple professional sports teams in all four of the major sports leagues, as well as several of the nation's largest college athletic programs.

Chris Grove, CEO of American Affiliate, a technology and media company focused on the U.S sports betting and online gaming market, told the Los Angeles Times in November that California legal sports betting could produce north of $3 billion in annual revenue, depending on what voters ultimately approve and how the facilities are managed.

Nevada sportsbooks produced a single-year record of $455.1 million in revenue based on $8.1 billion in wagers in 2021. That's one reason analysts, gaming operators and Nevada casino and tourism leaders have debated the state's ability to match up with the potential competition.

For some analysts, the answer can be found in Interstate 15 traffic jams.

"There's little reason to think that California sports betting legalization would represent a threat to Nevada's sports betting industry, in our view," Eilers & Krejcik Gaming analyst Chris Krafcik said in an email. The firm is based in Southern California.

"California drive-in traffic to Las Vegas remains strong despite the widespread availability of various types of gambling within California," said Krafcik, who follows sports wagering nationally.

Both ends of the state rely on California for tourism.

The Reno-Sparks Convention and Visitors Authority said in its most recent study that 27 percent of all visitors come from California. The Las Vegas Convention and Visitors Authority counted 30 percent of the Southern Nevada market's overall visitation as coming from California, with 27 percent of those visitors making the trek from Southern California.

Krafcik said Las Vegas has sportsbook offerings that provide "a level of destination appeal for sports bettors that other states, including California, simply cannot match."

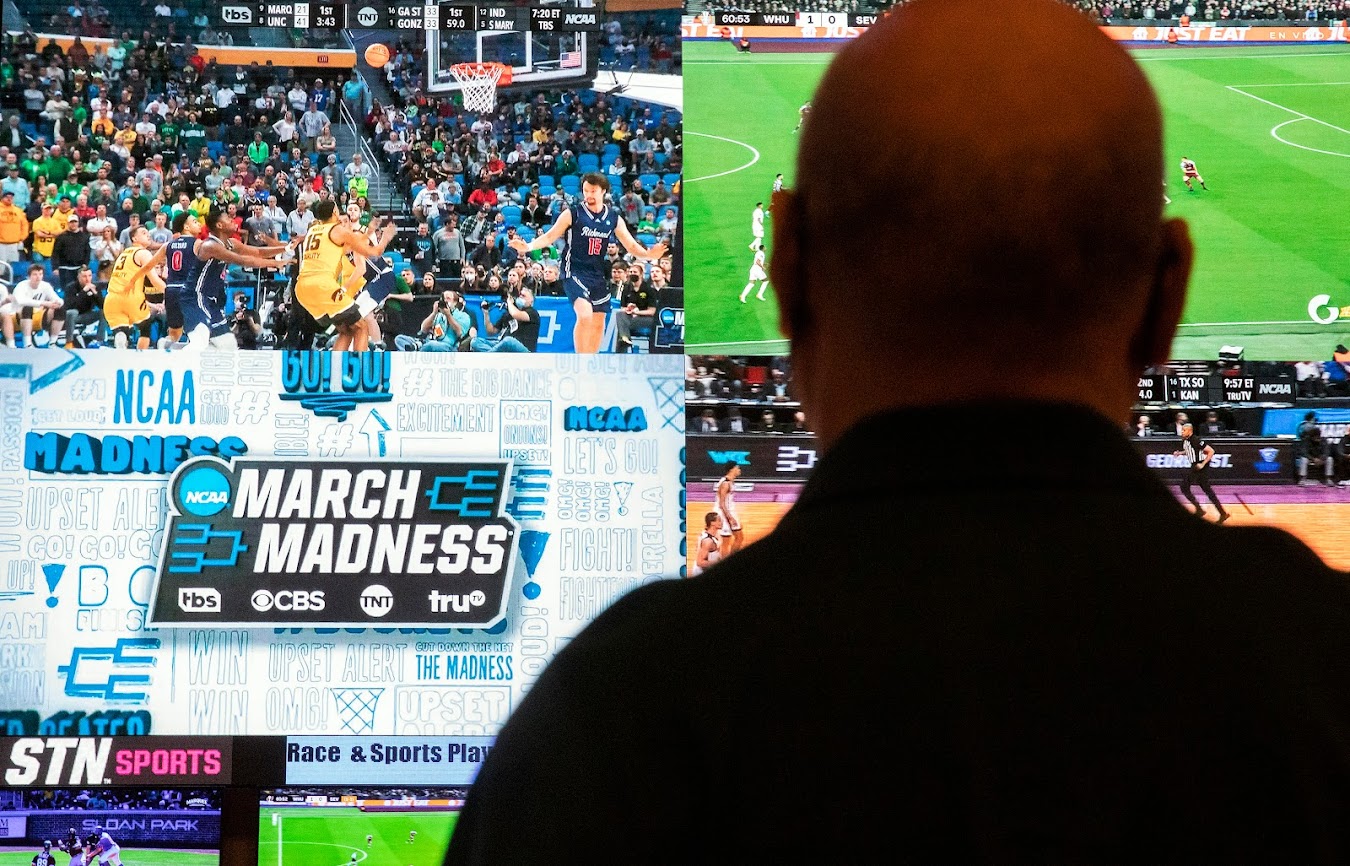

For example, Circa in downtown Las Vegas has a three-level sportsbook that includes private boxes, while the nearly 16,000-square-foot rooftop pool area includes a 40-foot tall television screen tuned to sporting events.

Art Manteris, who retired last year after managing sports betting for more than three decades at Caesars Palace, Las Vegas Hilton (now Westgate) and Station Casinos, was vocal in his worries for Nevada's sports betting future after 2018, when the U.S. Supreme Court ruled that states could legalize and regulate sports wagering.

"Some of us old-timers had serious concerns about Las Vegas' future when riverboat casinos started opening, and when Native American casinos opened," Manteris said.

"We were wrong every time," Manteris said. "So what happens to Nevada sports handle when California opens sports betting? Good question. But I've quit betting against Nevada."

A piece of the action

Legal sports betting has grown expeditiously in the past four years, with 30 states and Washington D.C. now offering legal sports wagering options through casinos, online platforms and state lotteries. Another three states are expected to launch the activity this year.

In 2021, the AGA said $57.2 billion was wagered in legal sports betting states. Nevada had the second-largest total with $8.1 billion in wagers, trailing only New Jersey's $10.9 billion. Analysts said it's unclear what California's entry into the market could mean to the nation's sports betting handle.

Nevada sports betting operators, however, will likely grab a piece of the action — Bussmann expects they will find some avenue to California, depending on how the ballot initiatives play out.

"You saw that with the expansion of tribal gaming with some of the management contracts that are in place or on facilities still in development," Bussmann said. "Nevada will be just fine should California allow sports betting and will likely thrive more than it is today."

Either tribal gaming-backed initiative could provide an opportunity to companies such as International Game Technology and Scientific Games' OpenBet (which is in the process of being sold). The manufacturers offer sports-wagering platforms and back-of-the-house services – including oddsmaking – to casinos to manage their retail or online operations. The casinos assume the risk from any wagers. The model is used by tribal casinos in Washington and Wisconsin.

Nevada gaming companies, primarily slot machine developers and gaming equipment providers, have been immersed in California's tribal gaming community since the rapid expansion began in the late 1990s.

Caesars Entertainment operates two California casinos – Harrah's Southern California in northern San Diego County for the Rincon Band of Luiseño Indians, and Harrah's Northern California, roughly 40 miles south of Sacramento, on behalf of the Buena Vista Rancheria of Me-Wuk Indians.

Boyd Gaming is building and will operate Sky River Casino, a $500 million property for the Wilton Rancheria Tribe that is expected to open later this year near Sacramento. Boyd has a seven-year management agreement with the tribe.

"We believe Sky River will be ideally positioned to become one of the region's top-performing tribal casinos," Boyd CEO Keith Smith said in February.

Red Rock Resorts, through its Station Casinos subsidiary, began operating two casinos in Northern California in 2003. Its partnership with Graton Rancheria near Santa Rosa ended last year, and the company is working with the North Fork Tribe near Fresno on a casino project that has been stalled by legal proceedings.

"We do not believe any decision by the California State Court could deprive North Fork of its ability to game on its federal trust land," Red Rock Resorts Chief Financial Officer Stephen Cootey said last month.

For now, Nevada casino operators are staying silent on California's sports betting efforts.

A closer look at the initiatives

At the end of 2019, a coalition of nearly 20 large and small tribes led by Southern California's Pechanga Band of Luiseño Indians announced their ballot question, hoping to place it before voters in the November 2020 election.

But the pandemic slowed the signature collection process, and a state Superior Court judge gave the tribes extra time to gather signatures. If voters approve the measure, tribal casinos and four horse racing tracks could open retail sportsbooks. The initiative does not include a mobile wagering component and restricts betting on events involving California colleges and universities.

Last fall, seven national sports betting operators – DraftKings, FanDuel, BetMGM, WynnBet, Bally's Interactive, Barstool Sports and Fanatics – launched their own petition drive, initially funded with $100 million, to qualify a ballot initiative that would allow online and mobile sports betting at tribal casinos.

The group said in its announcement last year that legal sports betting would bring "hundreds of millions of dollars of tax revenues" that would help fund mental health awareness and treatment programs and combat homelessness issues in the state.

Backers said the measure would require the national sports betting operators to partner with tribal casinos to either manage or assist in their sports betting operations in order to enter the state.

Company representatives declined to comment on the ballot initiative and referred questions to California-based political consultant Nathan Click.

Click said representatives from the mobile sports betting effort attended a meeting of the California Nations Indian Gaming Association (CNIGA) last fall to discuss the initiative.

"We believe our measure provides the best path forward for California, and we continue to gather support for it," Click said. "Our door continues to be open to all stakeholders. Our measure provides a number of new benefits and opportunities for California tribes."

But tribal leaders immediately set out to distance themselves from the sports betting operators.

In a February commentary published by CalMatters, two tribal chairmen, Raymond Welch of the Barona Band of Mission Indians and Greg Sarris of the Federated Indians of Graton Rancheria, called the online sports measure, "a deceptive statewide ballot measure aimed at legalizing online sports gambling would be bad for Indian tribes and bad for Californians."

The chairmen argued the measure would "put the future of sports betting in California in the hands of out-of-state, online gambling corporations."

A third initiative surfaced last year when three tribes – San Manuel Band of Mission Indians, Wilton Rancheria and Rincon – split away from the original coalition to push for a separate online and mobile sports betting opportunity that would be managed by the tribes.

A spokesman for the online tribal effort said the three tribes also support the retail-only effort.

In February, CNIGA Chairman James Siva said the trade group supported both tribal-backed sports betting efforts and rejected the measure pushed by the national sports betting operators.

"Tribal government gaming is the only form of gaming that is regulated at three levels of government and in keeping sports wagering with tribes, as both initiatives would do, promotes CNIGA's vision of a well-regulated gaming industry," Silva said in a statement. "Although tribes are not in unison on a path toward online sports wagering, there is no question that Indian Country is united in their fierce opposition to any corporate attempt to legalize online gambling."

Kathy Fairbanks, a spokeswoman for the retail sportsbook initiative, said the coalition hasn't taken a stand on the tribal-backed online and mobile wagering measure.

"The measure hasn't qualified for the 2022 ballot. If it does qualify, we will evaluate at that time," Fairbanks said.

A legislative perspective and the card rooms

Historically, debate on gaming expansion in the California Legislature erupts into heated disputes among the tribes, cardroom casinos and racetracks. Lawmakers failed in the last decade to legalize online poker because consensus could never be reached among the warring factions.

Sports betting found itself on the same landscape.

A year after the Supreme Court's sports betting ruling, Northern California state Sen. Bill Dodd introduced a bill to legalize sports betting that included the tribes, cardrooms and racetracks. The bill received a hearing in early 2020, but it was never acted upon.

A spokesman for Dodd said there are no plans to introduce sports betting legislation this year, and the senator had no comment on the ballot referendums.

Through a spokesman, California Gov. Gavin Newsom said he typically does not comment on potential or pending ballot initiatives and legislation.

The state's 72 cardroom casinos are the other factor. The facilities, typically located in small suburban communities, offer card-based table games and are not allowed to have slot machines.

The group has long been at odds with the tribal casino industry.

Last year, a sports betting initiative was proposed by a group of small city mayors seeking to include card rooms in the sports betting process. Tax revenue from the activity would be directed toward issues in their community.

The California Gaming Association (CGA), the trade association that represents the cardrooms, said it was never part of the petition effort, which never got off the ground.

CGA spokeswoman Becky Warren said cardrooms oppose the tribal-backed, retail-only initiative because the measure also has provisions that would allow Indian casinos to offer traditional craps and roulette, which are currently prohibited through the state compacts.

"This is the only initiative that has a provision that is aimed at harming cardrooms, cities and jobs," Warren said. "CGA has not yet taken a position on the other two initiatives that are currently collecting signatures."

Where do Nevada companies stand?

Nevada's casino companies, gaming equipment and technology providers and sports betting operators will lurk in the background until the votes are counted. Then, they will evaluate the landscape.

That's what happened in 1998. California voters overwhelmingly approved Proposition 5, which allowed gaming compacts to be formed between the state and Indian tribes and led to California's tribal gaming industry.

Nevada casino operators spent millions of dollars in opposition to Proposition 5, only to see more than 62 percent of voters approve the question. In the weeks following the defeat, several gaming companies had signed casino management contracts with different tribes.

This time around, most of the major gaming companies are staying quiet.

A spokeswoman for Caesars Entertainment declined to comment on the California sports betting efforts, given that the company's Southern California tribal partner, Rincon, is involved with the tribal mobile and online initiative effort.

Caesars also operates Caesars Sportsbook, which has grown into one of the nation's top four sports wagering providers, but was not listed as one of the seven operators backing the mobile and online initiative.

Similarly, Boyd Gaming owns 5 percent of FanDuel – a key backer of the online initiative – which operates the company's sports betting at its regional casinos in six states. Wilton, Boyd's tribal gaming partner, is fully opposed to the mobile effort that involves FanDuel.

A Boyd spokesman declined to comment on the California issues.

"First and foremost, I think we need to see [what] actually qualifies on the ballot and whether sports betting passes in California," Bussmann said. "I've seen polls all over the place and I think we need to see what actually will be on the ballot before we determine the potential fate of Nevada."

Bussmann predicted that the tribal-backed retail sportsbook initiative and mobile sports betting effort supported by the seven gaming operators would be the only two measures that land on the ballot.

"If voters have two distinct choices of a land-based only solution versus a mobile-based solution, it will provide for a robust campaign headed toward this November," Bussmann said. "Get your popcorn ready."

Support Local Journalism

You’ve enjoyed unlimited access to our reporting because we’re committed to providing independent, accessible journalism for all Nevadans.

But sustaining this work — informing communities, holding leaders accountable, and strengthening civic life — depends on readers like you.

Nevada needs strong, independent journalism. Will you join us?

A gift of any amount helps keep our reporting free and accessible to everyone across our state.

Choose an amount or learn more about membership