Small businesses eye fragile future as shutdown tests their survivability

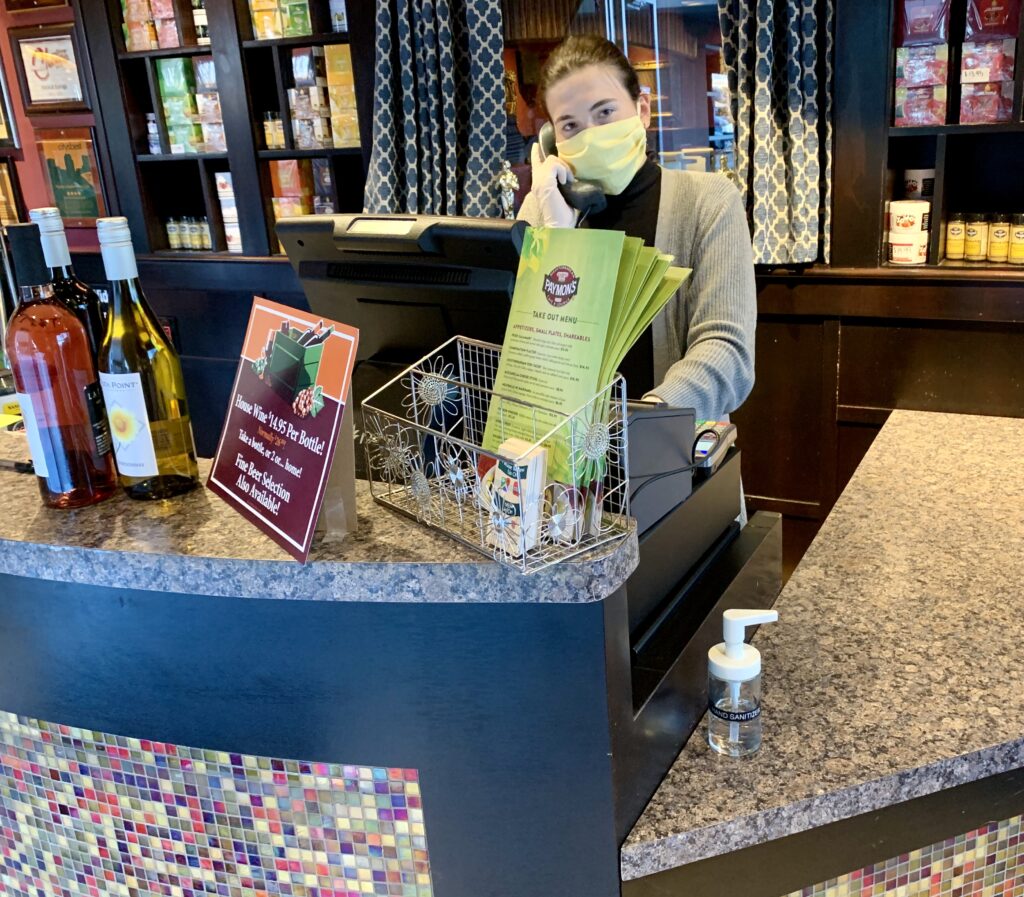

If customers didn’t know any better, they might think they made a wrong turn and ended up inside a medical office rather than Paymon’s Mediterranean Café & Lounge.

The front-desk employee dons a surgical face mask and rubber gloves. Bottles of hand sanitizer sit on the counter. But this is just business as usual for a Las Vegas restaurant trying to survive amid the COVID-19 pandemic.

At the eatery’s Eastern Avenue location, customers stream in and out, keeping social distance from others and grabbing tightly wrapped bundles of takeout food. When they will be allowed to dine in remains a big question mark. So for now, the longtime Las Vegas establishment with two locations is trying to scratch together an existence through curbside delivery or takeout service — an operation model that’s only netting 25 percent of normal revenue. Management furloughed about 62 of the restaurants’ 75 employees, marking the first economic-related layoffs in Paymon’s 31-year history.

“We’ve taken pretty good measures to try to keep people during all the difficult times,” said Jeff Ecker, owner of Restaurant Consultants of Las Vegas, which manages the Paymon’s restaurants on Eastern and Sahara avenues. “This one was just impossible.”

It has been nearly six weeks since Gov. Steve Sisolak ordered the closure of nonessential businesses in a bid to slow the fast-spreading upper-respiratory virus and not overwhelm Nevada’s health care system. State health authorities suspect COVID-19 cases have plateaued, but the governor has signaled he’s waiting for a confirmed downward trajectory before bringing pieces of the economy back to life.

Ecker supported the governor’s shutdown directive. The state, he said, needed to combat the life-threatening virus. Still, Ecker said he would like to see a “partial reopening” soon. He knows patrons won’t return in droves right off the bat. There will be an adjustment period.

The industry is also staring down a minimum wage increase that goes into effect July 1.

“We’re kind of in a scary spot right now as far as survivability of restaurants,” he said.

The same could be said for numerous other small businesses across the state. The safety-minded closures have limited, if not paralyzed, revenue for companies or organizations already operating on thin profit margins. Business chamber leaders in both Northern and Southern Nevada acknowledge that even if the governor gives the green light for businesses to reopen, some simply won’t be able to welcome back customers.

***

The questions came like an avalanche from the very beginning. As businesses deemed nonessential closed their doors, heeding Sisolak’s directive in mid-March, their owners flooded the Vegas Chamber with calls and queries.

Cara Clarke, the organization’s vice president for communications, said common questions included: How do I get a Small Business Administration loan? What other resources are out there? And what about rent?

“Businesses are really looking for answers, and they need a friend to guide them,” she said, “and that’s really our role.”

If one chamber role is serving as a conduit — connecting businesses with information and resources — the other is being a business advocate in government. But those dual purposes only go so far. Business survivability in the age of COVID-19 will depend on multiple factors, including the length of closures, a company or organization’s cash on hand and customer behavior in the aftermath, Clarke said. And at least some of those variables remain unknown at this point.

For instance, will customers feel safe returning to eateries and stores, even with social-distancing measures in place? Or will the shaky economy and health concerns encourage frugal spending patterns?

“We can guess at what that’s going to be, but nobody really knows what that will be for sure,” Clarke said, referring to customer behavior.

Ann Silver, chief executive officer of the Reno + Sparks Chamber of Commerce, said small businesses are stuck in a “miserable state” — waiting for federal relief funding, trying to make do with what they did receive or folding because they can’t make it with or without temporary aid. The chamber defines small businesses as organizations with fewer than 100 employees. Think places such as coffee shops, jewelry stores, clothing boutiques, bakeries or liquor stores.

Eighty percent of the northern chamber’s nearly 2,000 members are small businesses, and of those, 70 percent are considered nonessential businesses, Silver said. She worries that roughly 50 member businesses may not survive beyond the closure period.

“I don’t mean to sound terribly negative, but the small business community is suffering tremendously,” she said.

Late last month, Congress passed the Coronavirus, Aid, Relief and Economic Security (CARES) Act, which pumped $349 billion into the newly created Payroll Protection Program within the Small Business Administration (SBA). The program was designed as life support for businesses with fewer than 500 employees, but some large companies found loopholes and scored big sums, leading to partisan outrage. The CARES Act also expanded the SBA’s long-standing Economic Injury Disaster Loans (EIDL) program.

As of Monday, 549 loans totaling $118 million were approved for Nevada businesses under the Economic Injury Disaster Loans program, SBA Nevada district director Joseph Amato said. Silver State businesses, meanwhile, netted 8,674 loan approvals totaling roughly $2 billion through the Payroll Protection Program (PPP).

Other loan applications remain in the queue awaiting the next round of funding. President Donald Trump on Friday signed a new relief bill that includes $321 billion for the Payroll Protection Program as well as $60 billion for the disaster loan program.

Only 3.2 percent of Nevada small businesses received a PPP loan during the first round of funding, according to a Guinn Center analysis. That falls below the national average of 5.4 percent and places Nevada 50th among all states and the District of Columbia. California rounded out the bottom of the list, with just 2.8 percent of its small businesses receiving a PPP loan.

The Guinn Center analysis suggests Nevada is “under banked” and, therefore, does not have enough financial institutions capable of processing the loan applications. Iowa, a state with a similar population size, has one Financial Deposit Insurance Corporation-backed bank for every 900 small businesses, while Nevada only has one such institution per every 14,200 small businesses.

“The relatively fewer number of financial institutions in Nevada does provide some evidence to support the concern that capacity issues could have slowed the timely processing (of) PPP loans for many small businesses in Nevada,” the report notes.

On the plus side, Nevada ranked eighth for the size of its approved PPP loans. The average loan size for Nevada small businesses was $232,181, exceeding the national average of $205,614.

Paymon’s Mediterranean Café & Lounge received a PPP loan for one of its locations. Ecker, although grateful, said he wishes the federal assistance carried a more flexible timeline. The loan may be forgivable, meaning businesses don’t owe any money, if they use it for the approved percentage of payroll costs, mortgage interest, rent and utility payments over the eight-week period after receiving it. Employers who had cut workers prior to receiving the loan have until June 30 to restaff.

“There’s no reason to bring employees back in right now based on business volume,” Ecker said. “So the clock is ticking and it would have been much better had they allowed an eight-week period of your choosing.”

Action Camera in Reno is one of the state’s small businesses that so far hasn’t received approval for a PPP loan, said the store’s general manager, Craig Moore. The small business has another Action Camera location in Roseville, California.

Moore said the Reno store has been limping along during the closure, making $200 to $500 per day compared with the $3,000 to $5,000 in daily revenue it normally raked in before the health crisis. The camera shop furloughed its hourly workers, he said, but is trying to remain connected with customers by hosting online workshops, some of which are free.

Moore said he thinks the store can survive a closure through June 30, although he noted that’s an “extremely optimistic” projection. And he wonders what in-person customer traffic will look like after the shelter-in-place restrictions are lifted.

“My fear is that this pandemic and stay-at-home order make it perfect for people to push the Amazon button on the phone and computer and get really used to stuff arriving at their house,” he said. “I believe that’s going to be a bigger battle than it already was when we reopen.”

The governor has received criticism for not offering a more concrete reopening date — instead couching reopenings as a process that will occur in phases based on downward trends in positive cases and hospitalizations. Moore doesn’t consider himself one of those critics, saying he considers the situation “a waiting game” to avoid more people falling ill.

Other small business owners are calling for changes they think would level the playing field.

Karen Hyatt-Miner, owner of Vino 100 in Reno, questions why her neighborhood shop can’t remain open, while big-box retailers and grocery stores that sell some of the same products — such as wine, jams, olives and balsamic vinegar — can welcome flocks of customers.

Vino 100 received a call from the city’s Business License Division last week, instructing the store to close. Hyatt-MIner said she had been under the impression her store could remain open to sell food and beverage items as long as it closed a small bar inside.

She was assembling a to-go cheese platter order at the time of the phone call.

“If more people have to go to the same place because there are so few places open, how does that make us safer?” she said. “Explain this to me.”

With little wiggle room in her nearly $3,600 monthly rent, Hyatt-Miner, 52, said she fears the future of her business and economic livelihood.

“I’m working toward my retirement,” she said. “I’m not there yet. If I lost the business now, my retirement would be almost nothing.”

***

As businesses, many of them small and local, struggle, organizations are launching programs or brainstorming ways to help keep them afloat.

The Vegas Chamber partnered with Switch, Metro Police and ItsOnMe — a mobile gifting company headquartered in Las Vegas — to create the “Switch to Kindness” campaign, which allows people to purchase electronic gift cards from local businesses. Electronic gift cards can be donated to local first-responders or sent to the buyer’s recipient of choice.

Businesses that are members of the Vegas Chamber can participate. For those not already members, the organization is offering temporary free memberships.

The Nevada Small Business Development Center also announced it is beginning a social media campaign Sunday to support small businesses. The five-day challenge will involve activities that can be done from home, such as tagging businesses on social media, buying gift cards, writing online reviews and sending caring messages to business owners.

The Reno + Sparks Chamber of Commerce, meanwhile, has submitted a proposal that goes a step further to the Governor’s Office of Economic Development for consideration. Dubbed “curbside commerce,” the program would allow small, nonessential businesses to re-enter the marketplace by providing curbside sales.

The two-page memo outlines the process that would allow customers, one at time, to buy goods in a parking lot or driveway without hand-to-hand contact. For example, no money could be exchanged during the transaction, meaning all purchases would be completed by phone or online before scheduling a specific pickup time. Additionally, business employees would be required to wear face masks and gloves, and customers would need to display facial coverings.

“We understand and fully respect the governor’s focus on the health and safety of Nevadans,” said Ann Silver, the chamber’s CEO. “At the same time, I feel strongly that there are some very strict measures that small businesses could take to at least generate some income rather than slowly die on the vine waiting for phase one, phase two, phase three.”

Silver said she was trying to present the governor with “potential solutions, not just complaints.” She characterized the program as a “stepping stone to reopening” that would be tested within the chamber’s constituent area in Northern Nevada.

As someone who lived through the 9/11 attacks in New York City and saw people change their routines in the aftermath, Silver said it’s incumbent on the business community to innovate. She expects consumers to be wary of large groups for a while.

“What will be the new norm two years from now?” she said.

Even with outside-the-box thinking, it’s all but inevitable some businesses will fold.

Joseph Amato, the SBA Nevada district director, said the pandemic — a variable element outside of anyone’s control — could cause more business attrition than normal.

“Every economic cycle there are businesses that are basically lost due to attrition,” said Amato, an entrepreneur who studied economic cycles before joining the SBA. “Businesses that are strong will remain in business. The businesses that are weak will likely shut down.”

The SBA’s loan program, he said, tries to “fill that financial gap” and prevent some of the businesses from failing. At this point, no one can say with certainty how many will succeed, but Amato said Nevada’s small business owners have a history of resiliency.

Experts say the full extent of coronavirus-inflicted damage on small businesses won’t be known for quite some time.

“The vast majority of businesses that were deemed nonessential and told to close did so without a lot of resistance,” said Clarke with the Vegas Chamber. “They knew it was the right thing to do. There will be some of those that will have paid the ultimate sacrifice.”

Disclosure: The Nevada Independent was approved for a PPP loan.