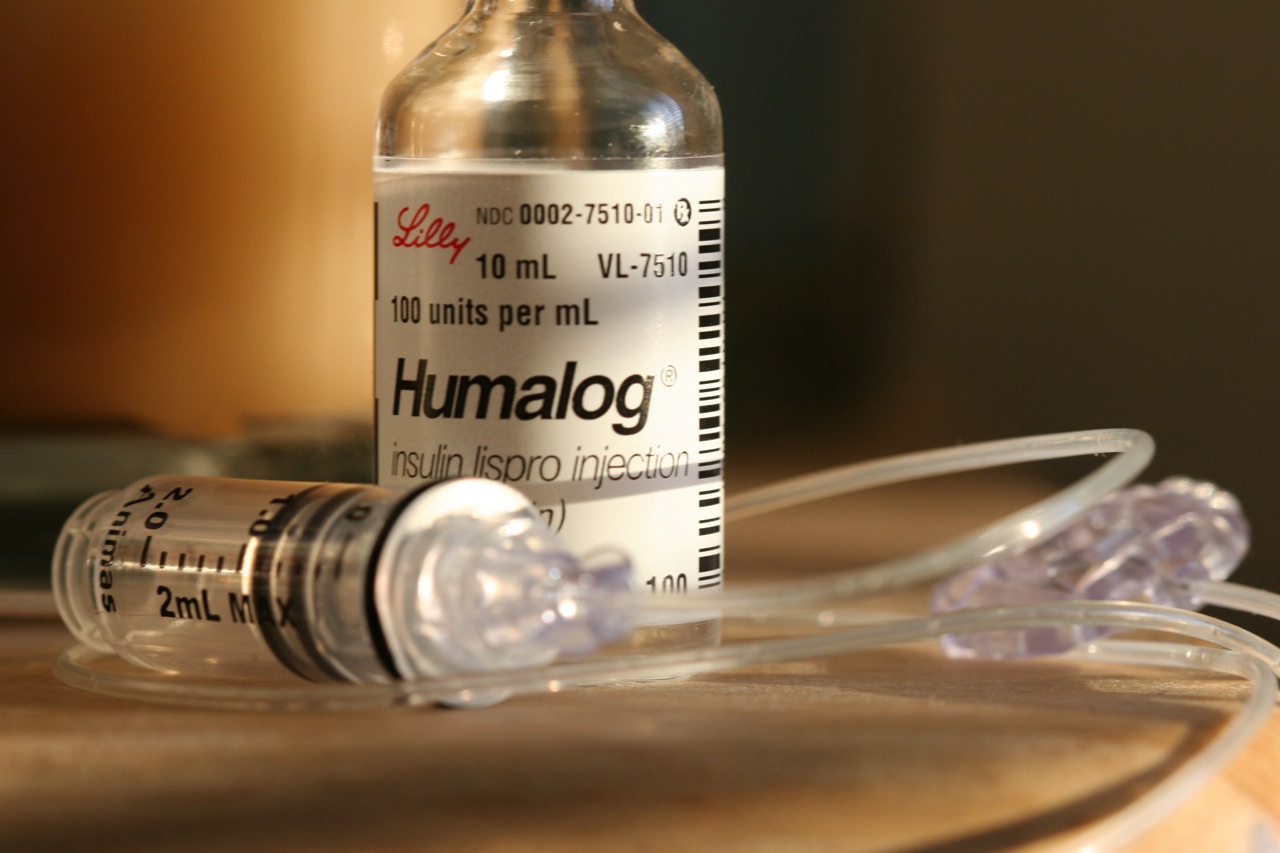

First diabetes drug transparency report reveals profits, costs associated with treating the disease

Drug manufacturers earned an average of $1.58 in profit for every $1 they spent on the production and administration of diabetes drugs in 2017, according to a report released by the Nevada Department of Health and Human Services on Monday.

But the diabetes drug report, which is the first of its kind to be published as a result of a drug transparency bill passed by state lawmakers in 2017, found wide variations in the profitability of drugs used to treat diabetes based on data provided by manufacturers to the state. Although some drug companies reported losses, 69 percent reported of manufacturer reports indicated profits greater than the combined cost of production and administrative expenditures, including some with profits more than 20 times combined costs.

In putting together that cost-to-profit ratio, the report only looked at administrative and production costs and did not include any other costs outside those two categories, including drug rebates and financial assistance to patients.

The analysis also found that the middlemen in the drug pricing process, known as pharmacy benefit managers or PBMs, retained 4.6 percent of rebates they negotiated with manufacturers for essential diabetes drugs. Some PBMs kept less than 1 percent of the rebates while others retained more than 15 percent.

The long-awaited report comes nearly two years after lawmakers passed a bill requiring manufacturers of diabetes drugs and PBMs to submit annual reports to the state detailing the costs associated with those drugs and explaining any price increases. The first report based on that information was initially slated to be released in September, but drug manufacturers were given a six-month extension to comply with the new law and file their reports. (The state did release a preliminary report in September.)

More than 60 drug companies and PBMs were required to submit detailed financial reports to the state in accordance with the new law.

By law and regulation, the state is barred from mentioning any specific pharmaceutical company, drug, or PBM by name in the report and is only allowed to discuss its findings in aggregate. In general, the state obtained national-level data from the manufacturers and state-level data from the PBMs.

But that aggregation requirement also precludes much deeper analysis or extrapolation of the data because the averages presented in the report come with significant margins of errors and vary wildly from the median values. A significant gap between the median, or the middle number in a list of sorted numbers, and average values and large standard deviations are indicative of outliers in the dataset.

In this case, the report attributed that significant variation to differences between large drug manufacturers and smaller ones, which were not separated out in the report. Big companies spent more on production and administration but also earned more profit, while small companies typically spent less and also earned less.

For instance, the report determined that average profit on essential diabetes drugs was $47.6 million, more than 165 times higher than the median profit, which was below $300,000.

Put simply, that means half of the profit numbers submitted were below $300,000 while the other half exceeded that amount, with possibly a few large, outlier profit numbers from the biggest players in the diabetes drug business driving up the average significantly. The analysis also noted that 28 percent of reports indicated that the drugs incurred either a loss or earned no profit.

That wide variation was also present in the average reported total drug production cost, $71.8 million, and average reported total administrative expenditures, $72.4 million, both of which were at least 50 times higher than their respective medians.

Based on those averages, the report noted that profits appear substantially less than either the drug production and the administrative costs, which is why it attempted to standardize the values between bigger and smaller companies in a profit-to-cost ratio.

“[The department] sought to analyze profits compared to production and administrative costs in a way that would decrease the impact of large drug manufacturers’ data on the overall averages,” the report states. “This profit analysis helped to remove the sizable variation between large and small drug companies as each reported value was normalized to itself.”

Drug companies lobbied heavily during the 2017 session to protect their financial data from disclosure and argued in court that the information is trade-secret protected. Manufacturers dropped the lawsuit after the state assured them through regulations that the individual data points would be protected.

Now, the national association representing drug manufacturers, which played a sizeable role in the 2017 lobbying efforts and the court case, is shrugging off the report.

“This report creates more questions than it answers,” said Priscilla VanderVeer, a spokeswoman for the Pharmaceutical Research and Manufacturers of America, in an email, “and it certainly will not help patients better understand or afford the cost of their diabetes drugs.”

In an interview, Democratic state Sen. Yvanna Cancela, who sponsored the 2017 legislation, said that she would have preferred transparency on every individual drug. But legal concerns prevented the state from doing so.

“In the absence of that, transparency on the averages still shed a lot of light on what happens in the diabetes care market,” Cancela said. “The report, I think, has such variation because we're looking at a broad set of drugs. To me, it's a reminder that diabetes care is not just about insulin; it's about a much broader set of drug categories.”

Julie Kotchevar, administrator of the Division of Public and Behavioral Health, noted that the report can only be as good as its data.

“This is the data reported to us. It’s not like we can go look at their books,” Kotchevar said. “There is a big difference in if you’re a big drug company that does research and development and produces the drug versus companies that are just the labeler. So because there’s a big variance in what makes up a manufacturer, there was a lot of variance in the data as well.”

In response to the report, the trade association for PBMs continued to blame drug manufacturers for high drug costs.

“Drugmakers alone have the power to set prices,” said Pharmaceutical Care Management Association spokesman Greg Lopes in an email. “The pricing strategies used by drugmakers, including for insulins, are not correlated to PBM-negotiated rebates.”

The report also examined the justifications drug companies provided to the state for increasing the price of their drugs. Though all diabetes drug companies were required to submit preliminary information to the state, manufacturers were required to submit detailed, secondary reports to the state if the cost of their drug increased by more than the medical care component of the Consumer Price Index (CPI) in the previous calendar year, in this case 2.5 percent, or twice the percentage increase in the CPI in the two prior calendar years, 12.6 percent.

The most frequent reasons manufacturers cited to explain why the costs of their diabetes drugs increased significantly were research and development investments (21 percent), changes in marketplace dynamics (12 percent), rebates provided to PBMs and insurance companies (10 percent), increases in drug production costs (9 percent) and inflation (8 percent.)

The report also noted that “one of the most unexpected response categories … was that price increases were specifically required to increase or generate profits,” a category that represented a total of 6 percent of the justifications for price increases. An appendix to the report stated that drug companies, in their reports to the state, referenced their “responsibility to improve or maximize value for investors or shareholders” or had increased prices to avoid not generating a profit at all.

Although pharmaceutical companies typically argue that profit is a motivating factor that incentives them to make hefty investments in research and development despite the risk, Cancela expressed concerns about the role of profit in setting drug prices.

“Regardless of the drug, when [profit] is a motivator for any drug manufacturer, that's a problem because we're talking about medicine that in some cases is essential to a person's life,” Cancela said.

Though the state was able to determine justifications for price increases for 94 percent of essential diabetes drugs that were identified as having significant price increases, it had to lean heavily on preliminary reports submitted by the companies. Of those 94 percent, only 43 percent submitted detailed secondary reports with specific data points relating to their price increases, such as the costs of producing and administering the drug, which were due Jan. 15.

The department is currently contacting companies that have not submitted the required price increase reports to obtain them, according to the report. If they refuse, the state is allowed to impose a fine of $5,000 a day.

But Kotchevar noted that the companies responsible for the biggest market shares of diabetes drugs have reported the required information to the state, and it’s the smaller manufacturers who may not be aware of the state’s reporting requirements who have yet to comply.

“So far, it has not appeared that the noncompliance is because of a refusal to report,” Kotchevar said. “I really do think it’s ignorance.”

The state’s analysis also found that 40 percent of secondary reports submitted by manufacturers indicated that they had provided some level of financial assistance through patient prescription assistance programs, with an average of $10 million provided, and 41 percent of reports indicated that they had provided some level of rebates to PBMs, or about $5.1 million on average. (Manufacturers were asked to provide state-level data for their PBM rebates.)

But the report also noted that the median value for financial assistance provided was $0, because of a significant number of manufacturers that didn’t provide any level of financial assistance. As with the profit and costs of administration and production, the report concluded that the $10 million average was inflated because of a subset of large manufacturers providing high levels of financial assistance.

In its analysis of PBMs, the report determined that the total reported rebates negotiated with manufacturers for essential diabetes drugs totaled almost $1.7 billion. However, a state official noted that the total may have erroneously included some national-level data from PBMs instead of just state-level data as initially intended.

Still, Kotchevar said that the information is useful in determining the percentages of overall rebates retained by PBMs. Of that $1.7 billion total, 4.6 percent, or $77.9 million, was retained by the drug pricing middlemen.

“I think the important part is really the trend,” Kotchevar said. “So whether it was national or state data, a lot of them are passing the rebates through.”

Kotchevar said that some of the shortcomings of the report, including the lack of clarity about at which level the PBMs should report, will be fixed in the upcoming reporting period. The next round of reports from manufacturers of diabetes drugs that experienced a significant price increase are due April 1, with the next state report due on June 1.

“We were trying not to be so prescriptive that [companies] couldn’t comply, and in some cases we weren’t prescriptive enough because then it didn’t provide enough guidance and we really want the data to be comparable,” Kotchevar said. “I think making sure our definitions are clear and our template is clear and easy to understand I think will be our biggest takeaway.”

She also said the state is working on ways to better normalize the data for the next round of reporting.

“We’re working on that because being able to provide context to this data is the most important thing otherwise people aren’t going to be able to use it to make a decision,” Kotchevar said.

For her part, Cancela said she is hopeful that the data can be used by policymakers and patients alike to push for changes in the drug pricing system, including her proposal to create a drug pricing review board.

“This lays the foundation for why transparency in drug pricing makes a difference,” Cancela said, “and I'm hopeful that this report can be used of what's evidence of what's possible when we shed transparency on drug prices.”

Support Local Journalism

You’ve enjoyed unlimited access to our reporting because we’re committed to providing independent, accessible journalism for all Nevadans.

But sustaining this work — informing communities, holding leaders accountable, and strengthening civic life — depends on readers like you.

Nevada needs strong, independent journalism. Will you join us?

A gift of any amount helps keep our reporting free and accessible to everyone across our state.

Choose an amount or learn more about membership