'Largest budget deficit:' State, local revenue projections show steep shortfalls

With the COVID-19 response squeezing resources and causing an abrupt fall in revenue, public entities across Nevada face a daunting task. Without federal intervention, cuts and furloughs are on the table as budget managers guide agencies through the bleak end of the fiscal year — with projected revenue cut in half, in some cases — and brace for more uncertainty to come.

For state agencies, counties and cities, these decisions could not come at a more challenging time. Many public sector employees — first responders, police, health care workers — are on the frontlines of the pandemic and in need of more, not fewer, resources.

The pie is getting smaller, though.

That is largely the result of a sharp decrease in funds generated through taxes on economic activity, including gaming, hotel rooms and the sale of products.

With economic activity at a standstill and unlikely to fully recover for months, if not a year, public agencies are preparing for less funding. They are in a similar position to states and local entities across the country that have asked the federal government to step in to cover revenue lost due to the COVID-19 response. Until Congress passes a new relief package, it is difficult to assess how much of a buffer that would provide.

But issues specific to Nevada could make the crunch harder here.

The state’s fiscal system is largely built around an economy dependent on tourism, a sector hit especially hard by COVID-19, said Jeremy Aguero, a principal analyst at Applied Analysis. The latest indicator: Gaming revenue was down nearly 40 percent in March compared to last year.

The largest source of revenue for the state is the sales tax, responsible for about 30 percent of state revenue. Of that, eating and drinking usually accounts for the largest slice of taxable sales.

Aguero forecasts that Nevada will see a $700 million to $900 million decrease in projected revenue from the state’s general fund as it closes out the fiscal year ending June 30. The shortfall for the next fiscal year is modeled at $1 billion to $2 billion, he said. The general fund is budgeted at about $4.4 billion this fiscal year and about $4.5 billion next fiscal year.

“It would be the largest budget deficit that the state of Nevada has ever had,” he said.

In Clark County, where about 73 percent of the state’s population lives, officials are expecting to see a 52 percent drop in revenue during the final three months of the fiscal year ending June 30, compared to last year. That is a loss of $118.1 million to the county’s general fund.

But it only scratches the surface. The University Medical Center (UMC), the Department of Aviation and the Las Vegas Metropolitan Police Department are also projected to take big hits.

That revenue decrease is expected to continue well into the next fiscal year.

County Manager Yolanda King said the situation has no historical comparison. Clark County has seen prolonged dips in revenue before, but never quite as suddenly and with such uncertainty.

It’s like “you have a running faucet,” King said. “And it just turned off in a matter of days.”

According to a presentation by officials to county commissioners on April 21, the county could see its expenditures exceeding revenues by $315.2 million in the next fiscal year.

“During the recession, the county essentially made a little more than $200 million in reductions to our budget over a four year period,” King said in an interview. “With the pandemic, we are essentially having to reduce our budget by $315 million in one year.”

In the short term, county officials said they were looking to fill a large portion of that budget hole by tapping into $152.3 million in one-time reserves and savings, reducing its non-operational contributions to local services, including Metro and UMC, containing agency costs and instituting a hiring freeze.

But it would still leave a gap of $58.4 million in next year’s budget. County officials told commissioners they would have to begin looking at workforce concessions, including furloughs, to avoid layoffs as much as possible. The $58.4 million represents about 11 percent of salaries and benefits in Clark County’s general fund, or about 580 positions.

The state has similar reserves that it could look to, at least for now.

Aguero said a $700 million to $900 million revenue shortfall — in this fiscal year alone — could be enough to burn through the state’s Rainy Day Fund, with about $400 million currently socked away, and excess dollars remaining in the general fund.

To help close the gap, Gov. Steve Sisolak has asked agencies to propose 4 percent cuts. Meghin Delaney, a spokesperson for Sisolak, said the office is reviewing those proposals.

“These reductions are necessary, but not something that the governor takes lightly,” Delaney said in an email. “Given the complex nature and the analysis required, the governor's office is moving diligently and expeditiously through the process to determine the best course of action.”

That 4 percent cut would take about $171.7 million out of the state budget.

Although March to June could see the largest drop in revenue, analysts expect the economy to recover slowly, with certain tax revenue sources dipping to near or below recession levels.

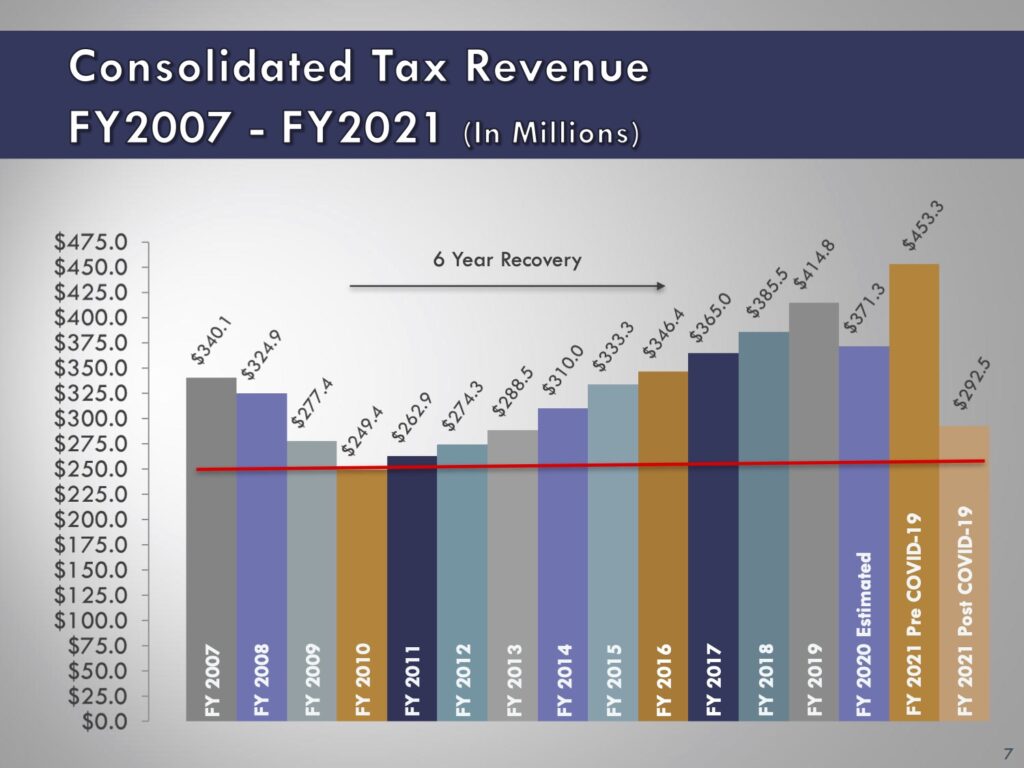

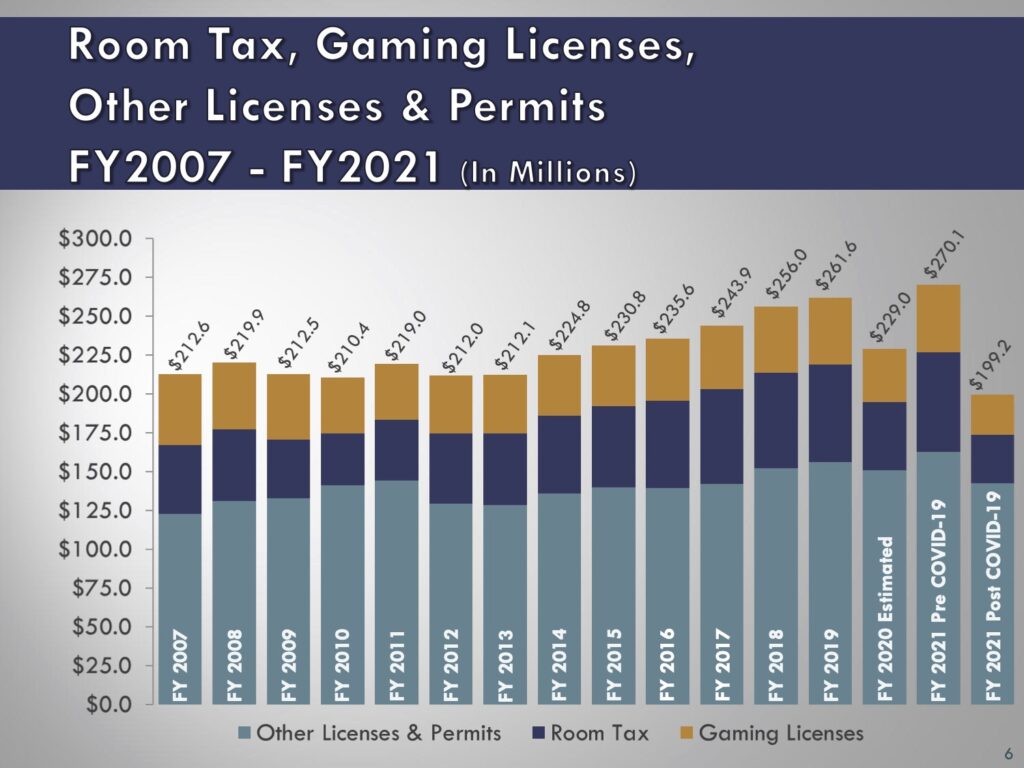

For instance, in Clark County’s presentation, room tax revenue for the next fiscal year is projected to fall by about two-thirds of what was projected before COVID-19. In Clark County, the consolidated tax, a large source of revenue for local governments and mostly composed of sales tax, is also projected to fall from what had been expected to be a high point since the recession.

“There will be significant impacts to county revenue,” Dagny Stapleton, who leads the Nevada Association of Counties, said in an interview on Tuesday. “There will be gaps. Many of our counties rely on sales tax as the number one or number two source of revenue.”

Many counties, she noted, have not fully recovered to pre-recession staffing levels. Although some revenue sources recovered, property taxes remain low, despite an increase in property values.

The prolonged nature of the economic hit for COVID-19, especially within the tourism industry, means that counties and the state could remain strapped for revenue, even after the economic restrictions are lifted. Aguero, whose firm provides technical assistance to Clark County, private businesses and other public entities, said his projections suggest it will take time for visitation to recover, and room tax revenues could face added pressure as operators slash hotel rates.

There is little analogue, Aguero said, when examining the models. His firm has compared the curve to the Great Recession, after the Sept. 11 attacks and the October 1 shooting.

“There is no doubt that the state's budget is going to be affected by the economic realities that we are dealing with,” Aguero said. “The only [questions are by] how much and [for] how long."

In addition to the 4 percent cuts requested to close out this fiscal year, Sisolak has directed agencies to identify even steeper cuts heading into the next fiscal year. The cuts could range up to 14 percent — about $516 million — according to a breakdown by The Nevada Independent.

Although budget managers can tap into reserves in the short-term, those options become more difficult moving forward. If revenues continue on a low trajectory, then governments and public entities will have to find a way to fill the deficit that the reserves had temporarily masked.

Take Clark County, for instance.

The county plans to draw $152.3 million in one-time reserves, savings and transfers to help fill its projected revenue shortfall in the next fiscal year. But because those actions are non-recurring, the county must fill the $152.3 million budgeting imbalance elsewhere if revenues remain low.

“The bigger challenge is going to be in [Fiscal Year 2022] when we don't have these one-time revenue sources to turn to and lean on," said Jessica Colvin, the county’s chief financial officer.

Other county services, with funding streams outside of the general fund, could also be hit hard.

According to a county estimate for a 16-month period from March to June 2021, Metro is looking at a $52 million loss of sales tax revenue. The Department of Aviation was expecting a revenue loss of $334.9 million. Having canceled its elective surgeries until May and with more costs responding to COVID-19, UMC could see a $300 million hit, a number Colvin said is fluid.

In all, the county said the fiscal impact could exceed $1 billion through the next fiscal year.

With states and cities across the country in a similar position, jurisdictions are pushing for the next federal COVID-19 stimulus package to include aid that can be applied toward revenue gaps. The first package, known as the CARES Act, provided funding to local governments but left lingering questions about whether that funding could be used to compensate for revenue.

On Tuesday, Democratic Sens. Catherine Cortez Masto and Jacky Rosen signed onto a letter asking Treasury Secretary Steve Mnuchin to allow CARES Act funding to go toward lost revenue.

Even without the CARES Act funding going toward revenue, it could provide a buffer for the drop in sales, Aguero said. He estimates that Nevada could see as much as $17 billion from the stimulus, a figure that includes everything from payments to individuals to support for businesses.

As Congress mulls additional legislation to buoy the national economy, Democratic Rep. Dina Titus, who represents Clark County, said in a statement that the next bill “must do more.”

“In our next relief package, we must make sure those funds can be used to cover budget losses in large cities and small towns,” Titus said. “Otherwise, it’s not just local government jobs that will be lost – so will many of the essential services that counties and cities provide.”

For Clark County, legislation could help fill the budget gap in the short-term. But the concern is what happens in the long-term. The county’s current models assume an interrupted recovery. If COVID-19 makes a resurgence and new economic restrictions are put in place to slow the spread of the virus, it could place the county in an even more difficult position.

“That would change the recovery model significantly,” Colvin said.