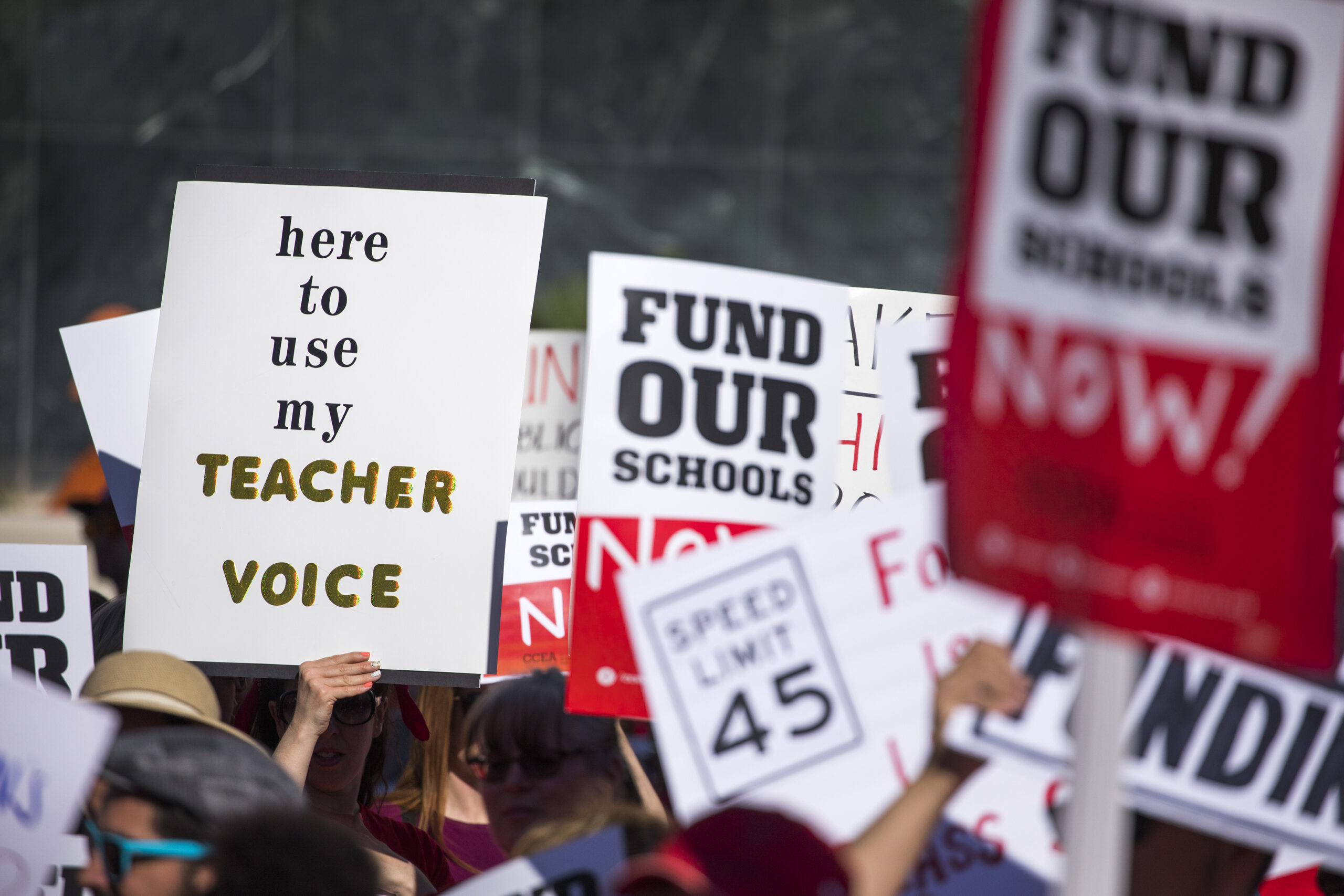

CCEA-backed tax proposals submitted with almost double the number of required signatures to qualify

Two ballot initiatives backed by the Clark County Education Association that would raise the state’s sales and gaming tax rates have garnered enough signatures to move forward to the 2021 Legislature, setting up a potentially politically fraught fight over taxes next year.

The union submitted nearly 200,000 signatures for each petition to county election officials on Tuesday, one day before the deadline set in state law for initiative petition backers to submit the required 97,598 signatures. John Vellardita, executive director of CCEA, said the teachers’ union “clearly ran up the score” with the number of signatures collected — roughly double what was needed — while also navigating a pandemic.

“We’ve accomplished what we set out to do,” he said. “We want legislators, the business community to understand that all we want to do is have a conversation about how to rebuild this economy and invest in education.”

The union announced the pair of initiatives in January as a solution to raise revenue necessary to fully fund Nevada’s K-12 education system. At the time, the union estimated that the tax rates would raise an extra than $1 billion per year.

One initiative would raise the state’s Local School Support Tax from 2.6 percent to 4.1 percent and bring the state’s baseline sales tax rate to 8.35 percent. Individual counties have differing sales tax rates, meaning that change would result in a 9.875 percent sales tax in Clark County.

The union’s other initiative would raise the state’s gaming tax rate from 6.75 percent to 9.75 percent. The Nevada Resort Association in January balked at the proposal and issued a blistering statement, saying it amounts to a “44 percent tax increase” that would damage the state’s economy.

In a statement on Monday, the trade association representing the state's largest casino companies said it backed a "broad-based" business tax, but that CCEA's proposal would result in "devastating ramifications for the state’s economy, Nevada's businesses, individuals and families."

"As Nevada’s largest industry and economic engine continues to do all it can to recover and bring employees back to work, now is not the time to target the resort industry with a 44 percent tax increase that would further damage Nevada’s recovery efforts, create permanent job losses and further jeopardize capital investment and future economic development," a spokeswoman for the group said in an emailed statement.

CCEA spent considerable sums in its effort to qualify the petition. The two political action committees set up to garner the signatures — Nevadans for Fair Gaming Taxes and Fund Our Schools — raised a combined $1.54 million from the union over the past calendar year.

The resort association has long backed broad-based business taxes to support education and given how COVID-19 has pummeled the state’s tourism industry, its economic fears are undoubtedly exacerbated. The Las Vegas Visitors and Convention Authority reported that in September — more than five months into the pandemic — visitor volume was down 51 percent and Clark County gaming revenue was down 40 percent compared with the prior year.

The pandemic’s swift cratering of state tax revenue doesn’t bode well for K-12 education funding, which saw millions of dollars cut during a special legislative session in July. Additionally, Gov. Steve Sisolak has asked state agencies to propose 12 percent budget cuts for each year of the 2021-2023 biennium.

The initiatives are likely to face immediate legal challenges by the Nevada Resort Association and Las Vegas Chamber, two business groups that have filed myriad legal challenges against the proposed initiatives over the past year.

The groups filed an initial lawsuit challenging the 200-word “Description of Effect” on signature-gathering forms, which succeeded in district court, and went as far as to intervene in a federal court case regarding an abortion-related ballot question to argue against any judicial-ordered extension of the signature-gathering deadline.

After the signatures are submitted to individual counties, those totals are reported to the secretary of state’s office, which determines whether the number of collected signatures exceeds the minimum threshold — 97,598 signatures, with at least 24,400 collected in each congressional district.

If that initial raw tally of signatures meets the requirement, the process is kicked back to individual county clerks, who then have nine business days to complete a signature verification process. Under state law, that process takes the form of a random sampling of 5 percent of total signatures contained on the petition, with those results submitted back to the secretary of state’s office.

Once all counties have reported back to the secretary of state, the office then either certifies the petition as having enough signatures and sends it to the state Legislature, orders it failed if the number of signatures is less than the 90 percent needed, or, if the verified signatures are between 90 and 100 percent of the total needed, orders counties to conduct a full verification of all submitted signatures.

If successful, the measure then moves to the 2021 Legislature, where lawmakers will be on a constitutionally-mandated 40-day clock to take action on the initiative. If rejected or no action is taken, it is then required to be placed on the next election ballot — 2022, in this case. If approved by voters, lawmakers are not allowed to amend or change any of the provisions for a three-year period.

Despite the economic uncertainty amid the pandemic, Vellardita framed the proposed tax increases as K-12 investment tools that could still be more than a year away from implementation.

“That’s a long way off,” he said. “I think the world we see today is not the world we will be experiencing in 2022.”

The measures would become law if they’re passed by the Legislature and approved by the governor. The Legislature is also given constitutional authority to reject the petition and adopt an alternative on the same subject, in which case both the legislative and original petitions would be placed on the next general election ballot. Assuming both pass, whichever version has the most votes becomes law.

Updated at 8:40 p.m. to include a statement by the Nevada Resort Association.

Support Local Journalism

You’ve read unlimited free articles this month because we’re committed to providing independent, accessible journalism for all Nevadans. But we can’t continue informing and empowering our communities without the support of readers like you.

Nevada Needs Strong Civic Power. Will You join us?

A contribution of any amount helps keep our reporting free and accessible to everyone across Nevada.

Choose an amount or learn more about membership